US Port Strike Poses Fresh Inflation Risk: Impacts on Supply Chains and Prices

Tuesday, 1 October 2024, 23:46

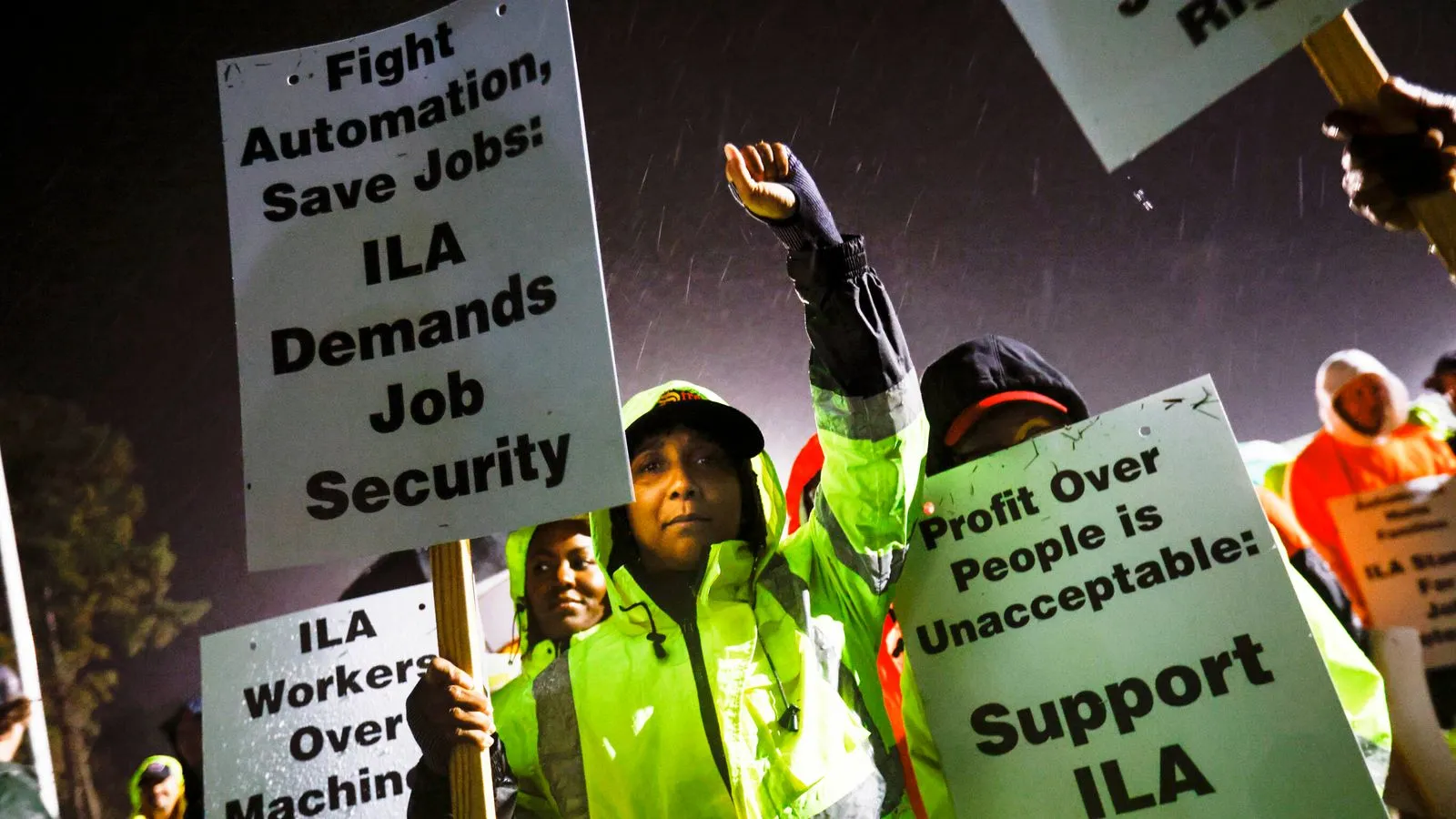

US Port Strike Overview

The ongoing US port strike poses fresh inflation risk, affecting trade and logistics at 36 major ports. Companies are scrambling as disruptions unfold.

Impacts on Supply Chains

- Inflationary Pressures: As shipping delays increase, prices may rise.

- Contingency Planning: Many companies are shifting to air freight to mitigate risks.

- Global Implications: This situation is expected to reverberate beyond the US borders.

Market Reactions

- The stock market has shown volatility amidst uncertainty.

- Consumer goods prices may increase significantly if strikes persist.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.