Apple's Q2 Report: Profit Margins and New Investments

Highlights

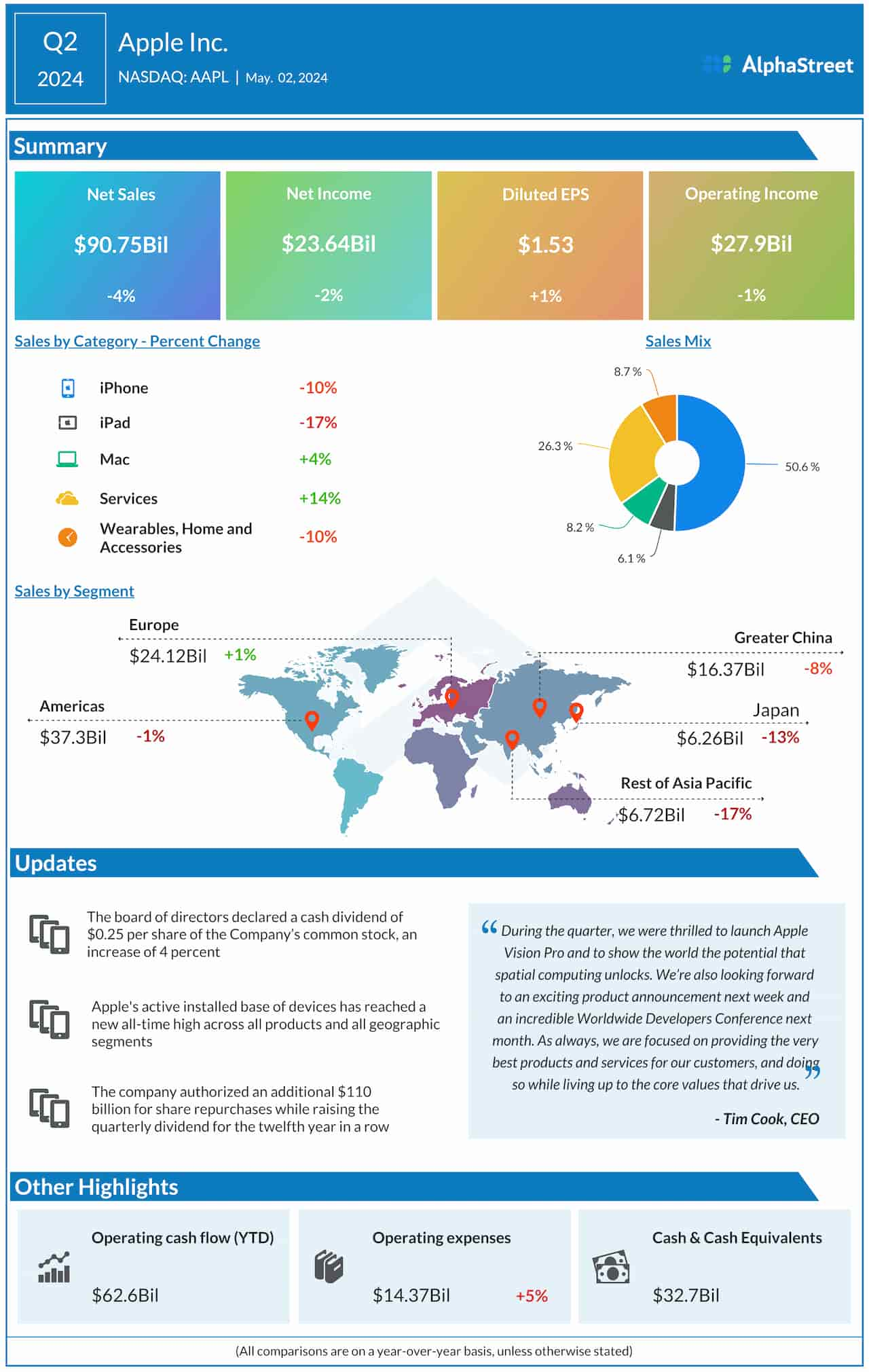

Apple (NASDAQ: AAPL)'s stock rallied following strong earnings and a $110 billion share buyback program announcement. Despite a 4% dip in revenues, profit margins remained healthy, exceeding Wall Street's estimates.

- iPhone Sales: Declined 10% to $46 billion; Services revenues surged 14%.

- Revenue Boost: iPhone sales were delayed last year, making YoY comparisons challenging.

Sales Performance

Sales of iPhone, iPad, and Wearables witnessed declines, overshadowed by Services' robust growth. Active installed base crossed 2.2 billion, reflecting stable demand.

Outlook

Apple expects an upward trend in iPad sales and continued growth in the services segment. The recent launch of Vision Pro indicates potential revenue growth in the near future.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.