Why Investing in Meta Stock During the Dip Might be a Smart Move

Despite a solid earnings report, shares in Meta have fallen roughly 12% since reporting first-quarter results.

One of the hottest stocks among the 'Magnificent Seven' has been Meta Platforms (NASDAQ: META). After a rocky performance in 2022, shares in the advertising behemoth soared 194% last year following an impressive return to growth on both the top and bottom lines.

Reasoning Behind Increased Spending Forecast

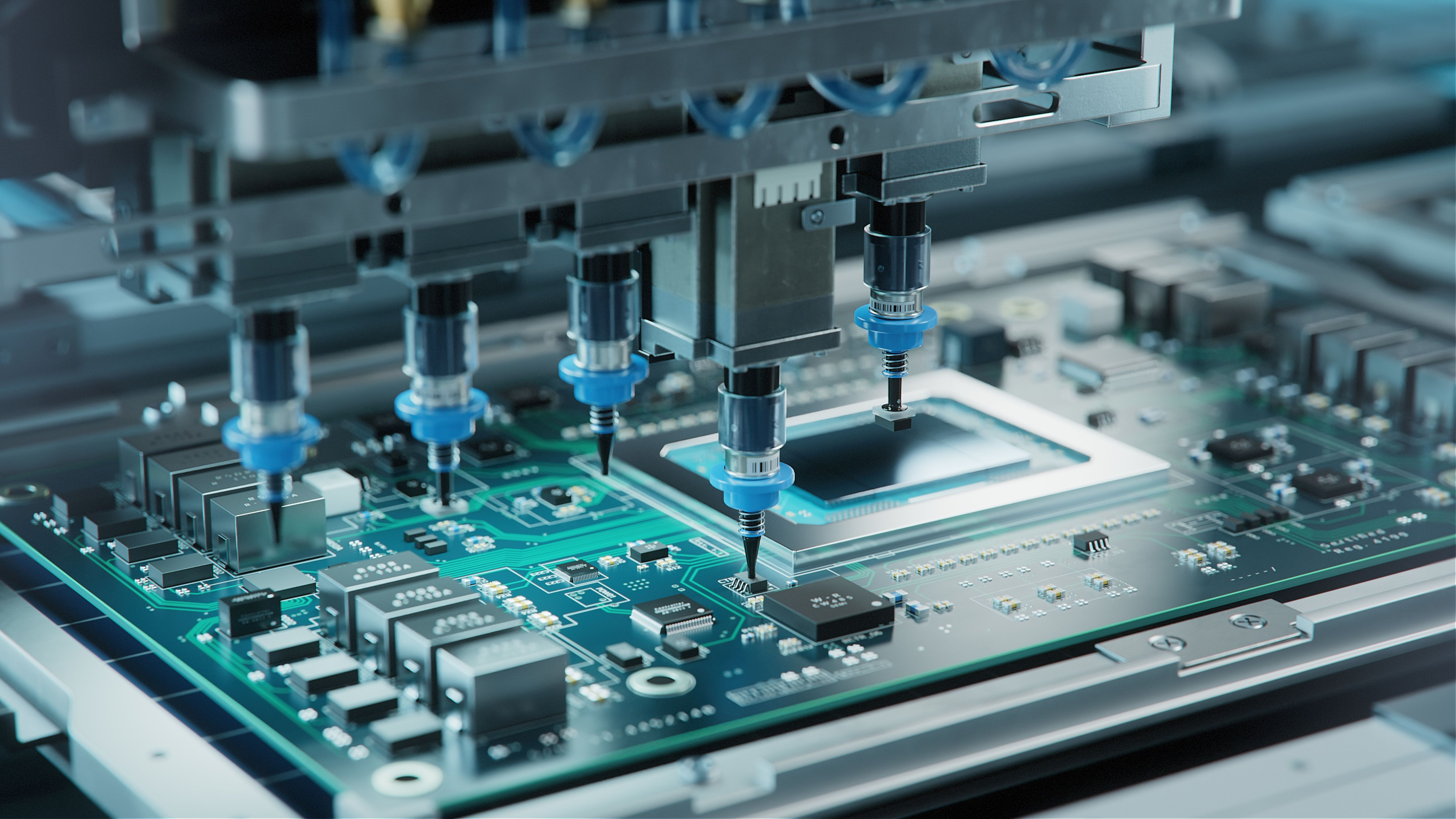

During the company's first-quarter earnings call, Meta disclosed plans for higher capital expenditures in 2024, primarily driven by chip development and infrastructure investments. The move to in-house semiconductor chips could provide a competitive edge and long-term cost savings.

- Profitability Amid Increased Expenses: Meta is known for its profitability and financial flexibility, with a focus on reinvesting profits back into the business.

- Infrastructure Investments Analysis: Parsing through management's commentary reveals the strategic rationale behind the increased capex, including the development of in-house semiconductor chips.

Investment Considerations

With Meta stock trading below its average ratios and forward P/E lower than peers, the current dip presents a potential buying opportunity. Internalizing AI efforts and tech stack enhancements signal Meta's focus on long-term growth and operational efficiency.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.