Inflation in Europe Declines, Raising Expectations for Interest Rate Cuts by European Central Bank

Impact of Declining Inflation on European Central Bank's Decision Making

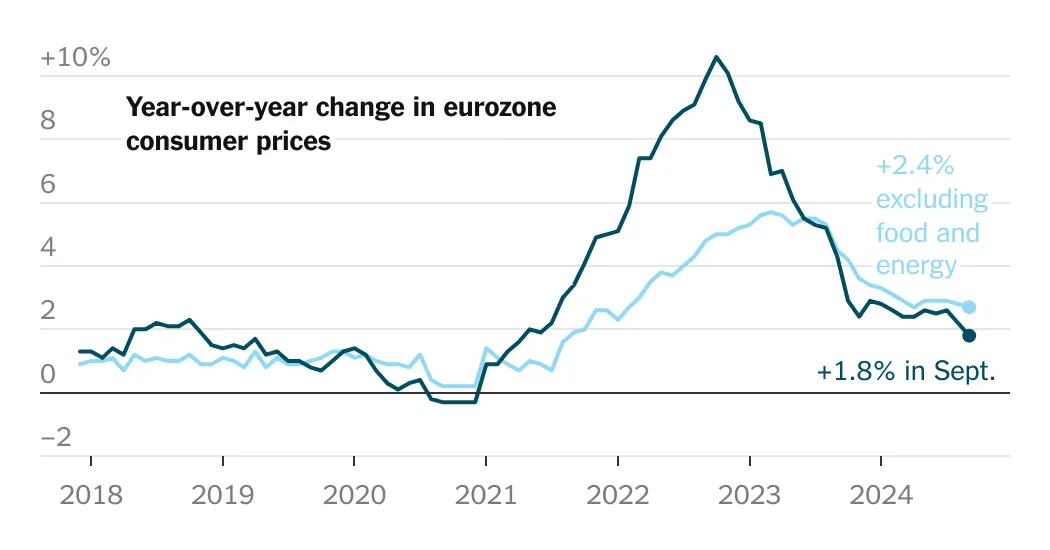

As inflation in Europe cools to 1.8%, the landscape for interest rate adjustments becomes increasingly relevant. Investors are speculating on the direction of the European Central Bank (ECB) as the economic atmosphere continues to shift.

Investor Sentiments and Economic Indicators

The current economic environment poses challenges, including rising unemployment and stagnant growth. Indicators like GDP and consumer spending are critical to understanding future policies.

- Inflation Reduction: The recent dip in inflation rates is pushing policymakers to reconsider their strategies.

- Rate Cuts Anticipation: Investors are on edge, speculating on the ECB's next moves.

- Potential Stimulus: A cut in interest rates might stimulate growth.

Understanding the European Economic Landscape

With macroeconomic pressures at play, the reactions from the ECB will significantly influence the European economy. Rate adjustments are crucial in responding to the ongoing economic struggles.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.