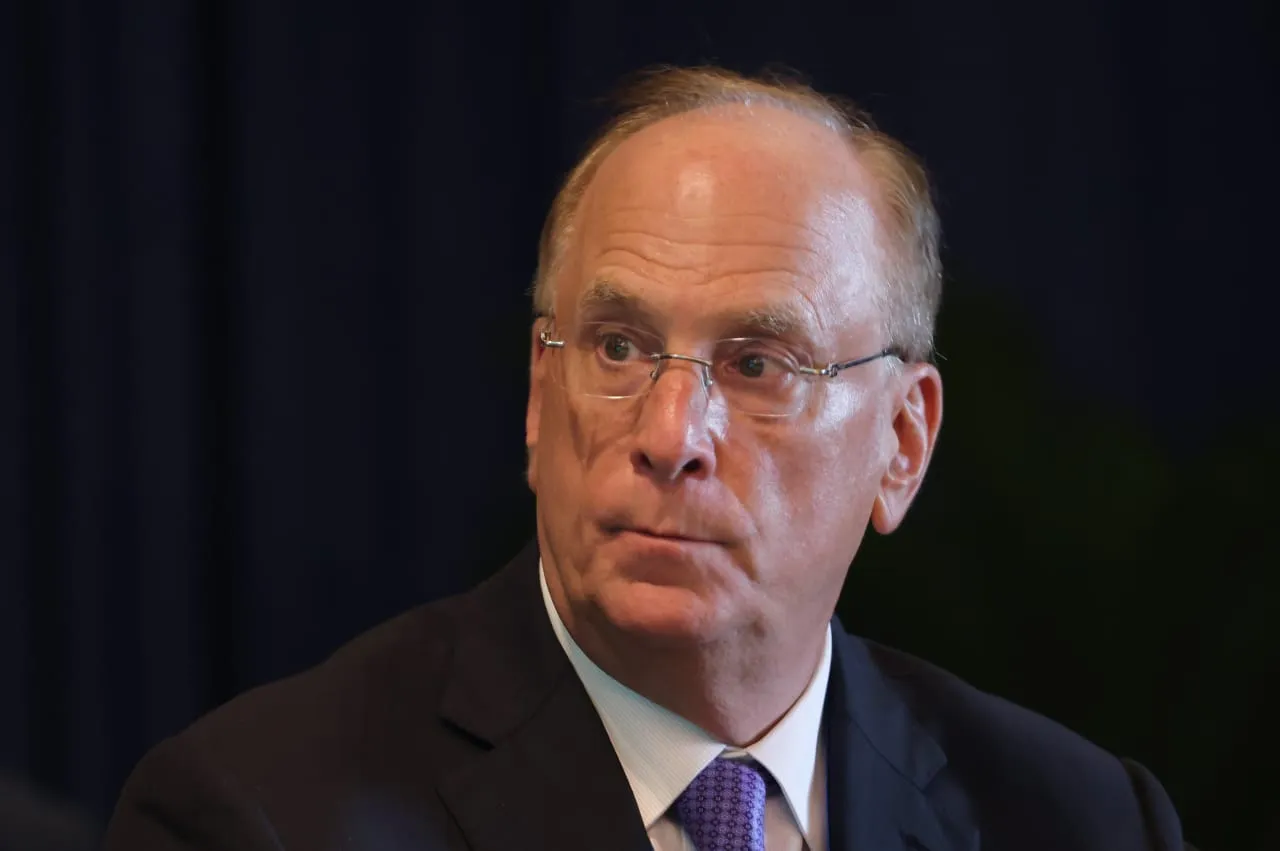

Market Bets on Deep Fed Rate Cuts: Insights from BlackRock’s Larry Fink

BlackRock's Fink on Market Sentiment

Market bets on deep Fed rate cuts have raised eyebrows in the financial community. Larry Fink, CEO of BlackRock, labeled these trader expectations as 'crazy,' highlighting a divergence between market behavior and the actual strength of the economy. In his view, traders are overly optimistic in forecasting significant reductions in rates.

The Reality of Economic Indicators

The economy shows consistent signs of resilience, which suggests that substantial cuts may not be necessary. Fink pointed out that key economic indicators remain strong, making such predictions shortsighted. This perspective urges traders to reassess their assumptions about interest rates and market movements.

Investor Strategies Moving Forward

- Reevaluate Risk Exposure: Investors should consider the implications of aggressive trading strategies based on rate cuts.

- Diversification: It’s pivotal for investors to diversify to mitigate risks tied to misinterpreting economic signals.

- Watch Economic Trends: Continuous monitoring of economic reports will help in making informed investment decisions.

For more insights on market strategies and economic forecasts, it's beneficial to keep abreast with expert opinions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.