Chinese Stocks Surge: What Does It Mean for Investors?

Chinese Stocks Surge Amid Market Sentiment

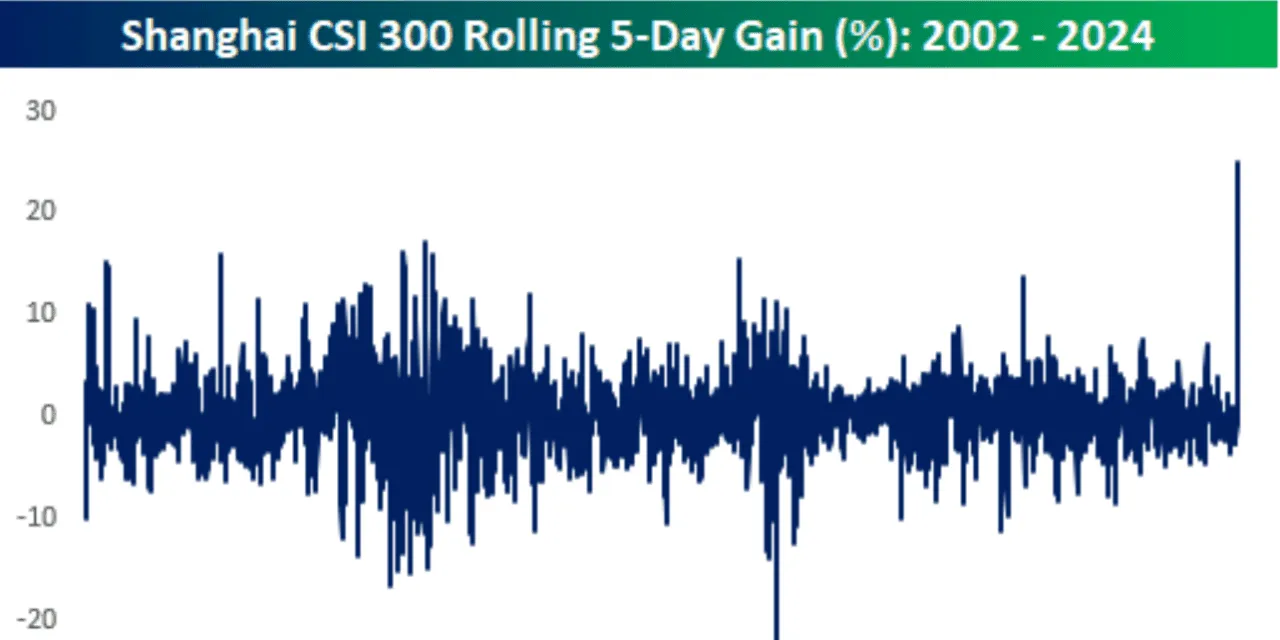

Chinese stocks have experienced a remarkable surge in the past five days. However, it’s crucial to note that they still remain in the hole. According to financial analysts at Bespoke, despite the recent bullish sentiment, the CSI 300 index is currently down over 30% from its peak in February 2021.

Focus on the Drawdown

- From the post-COVID high, the index reflects ongoing struggles.

- The current index performance shows a modest decline over the past two years.

- Investors need to analyze the broader market trends despite recent gains.

What Lies Ahead for Chinese Stocks?

- Continued analysis of economic data is critical.

- Market predictions will dictate future investment strategies.

- Risk management strategies must be a priority for investors.

As we move forward, understanding the implications of this surge will be vital for navigating investment decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.