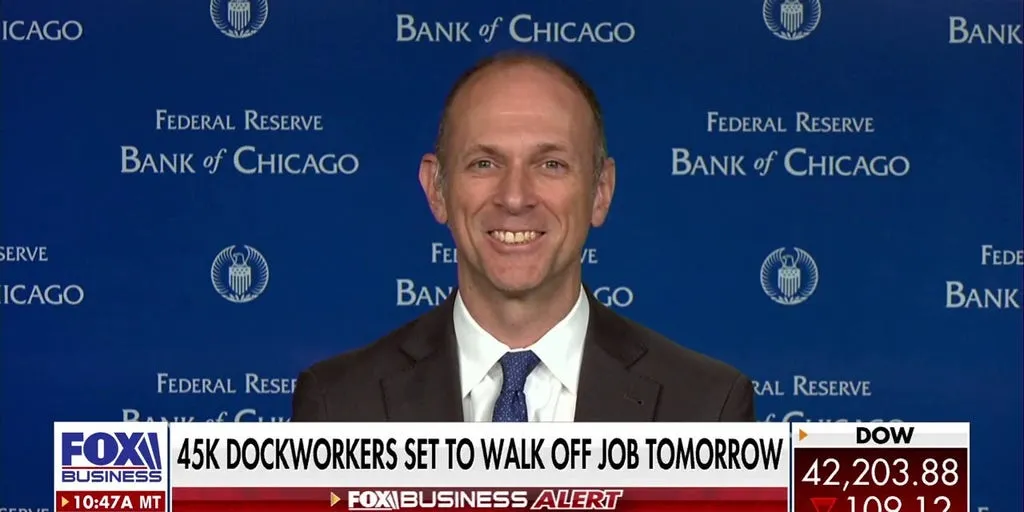

Austan Goolsbee Expresses Concern Regarding Looming Port Strike and Economic Fallout

Economic Implications of the Looming Port Strike

Chicago Federal Reserve Bank President Austan Goolsbee has expressed growing concern regarding the potential of a significant port strike affecting economic stability. This situation poses unique challenges for the Federal Reserve’s rate-cutting strategy, as disruptions at ports could lead to supply chain issues and impact inflation rates.

The Urgency of Resolution

With deadlines rapidly approaching, the risk of disruptions looms larger. Goolsbee emphasizes that resolving the port situation is critical as it directly correlates with overall trade stability and future economic growth.

Potential Outcomes

- Immediate Economic Repercussions: Disrupted supply chains could inflate prices.

- Long-term Trade Impacts: A prolonged strike may lead to lasting shifts in market dynamics.

- Central Bank Responses: The Fed’s decisions will hinge on evolving inflationary pressures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.