Wall Street Analyst Predicts Intel Stock to Hit $17: Is it Time to Sell?

Intel's $17 Price Target Prediction

Intel recently faced a significant drop in stock value following its earnings report. Analysts, including Hans Mosesmann, expressed concerns and lowered price targets, with Mosesmann maintaining a sell rating and projecting a $17 target, indicating a potential 50% decline.

Revenue Growth and Earnings Decline

Despite beating estimates, Intel's revenue growth remained modest at 9%, leading to disappointment among investors. The company's outlook for flat revenue growth in the second quarter and declining earnings contributed to the negative sentiment.

Challenges in CPU Market and AI Era

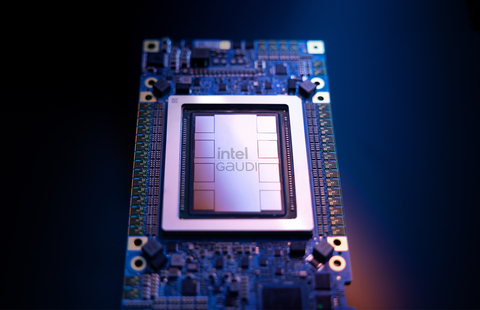

- Shift to GPUs: Budgets are likely to move from CPUs to GPUs in the AI era.

- Real Results in AI: Intel needs tangible outcomes in AI to compete effectively in the market.

Intel's need to prove its worth in the face of structural challenges and shifting markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.