Hedge Funds Rotate Out of Tech as China Stocks Experience Record Net Buying

Hedge Funds Shift Strategies Amid Changing Market Dynamics

Recent findings from Goldman Sachs highlight that hedge funds (HFs) are rotating out of traditional sectors such as Information Technology, Energy, and Financials. Instead, there is a noticeable trend toward investments in Consumer Discretionary, Materials, and Consumer Staples.

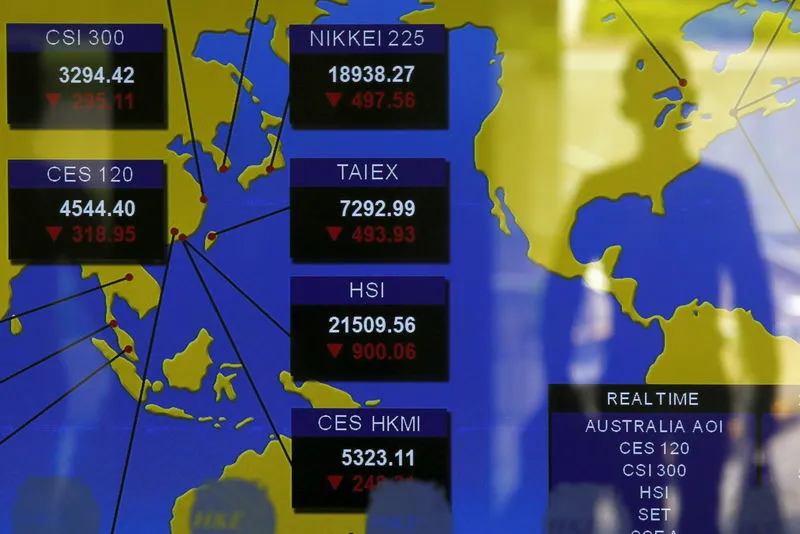

Record Buying in China Stocks

According to the report, China stocks saw the largest weekly net buying on record, signaling a robust interest among investors to leverage emerging market opportunities. This shift suggests a potential reassessment of global economic forecasts, with funds looking to capitalize on resilient segments of the market.

- Hedge Fund Strategies

- Sector Rotation

- Investment Trends

Implications for Future Investments

As hedge funds adjust their portfolios, the implications for future investments could be significant. Analysts believe this move could impact market forecasts and potentially influence policy decisions among sectors previously considered stalwarts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.