Politics Affecting Stocks: Implications of Japan's New Prime Minister on Interest Rates

Political Shifts and Stock Dynamics

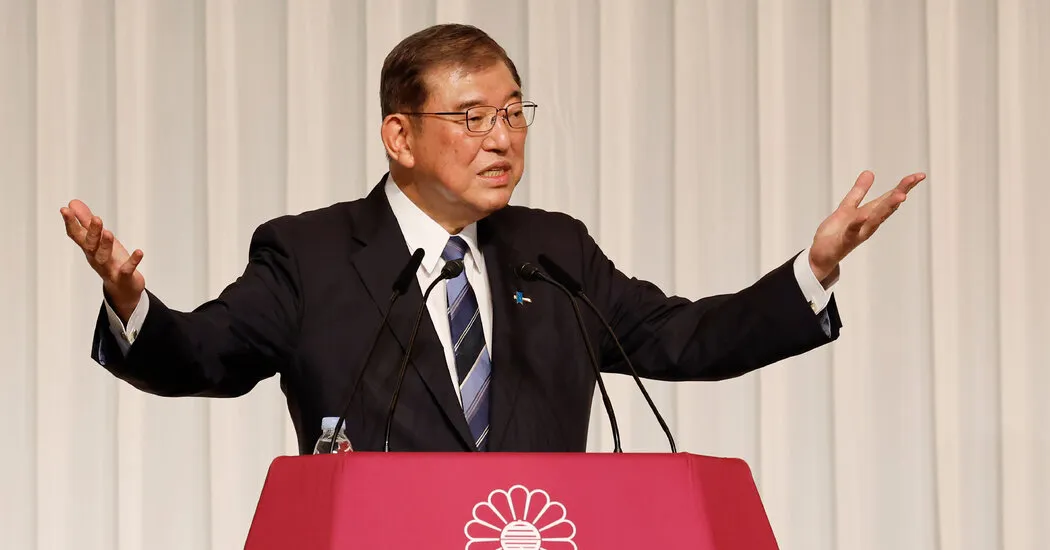

Politics are reshaping stock markets across Japan, particularly following the election of Shigeru Ishiba as the Prime Minister by the Liberal Democratic Party. Ishiba's position against the country’s longstanding ultralow interest rates raises questions about the future of government bonds and their impact on inflation.

Impacts of Interest Rates on the Economy

As fears of rising interest rates surface, economists warn that this could lead to a ripple effect through the economy and affect stock valuations. Investors are bracing for possible turbulence as stocks react to political changes.

- Shigeru Ishiba's policy changes

- Government bond performance

- Potential inflation concerns

- Market reactions to political leadership

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.