Investing in Taiwan Semiconductor Manufacturing Company (TSMC): Key Financial Growth and Market Opportunities

Your favorite tech company's favorite chip supplier

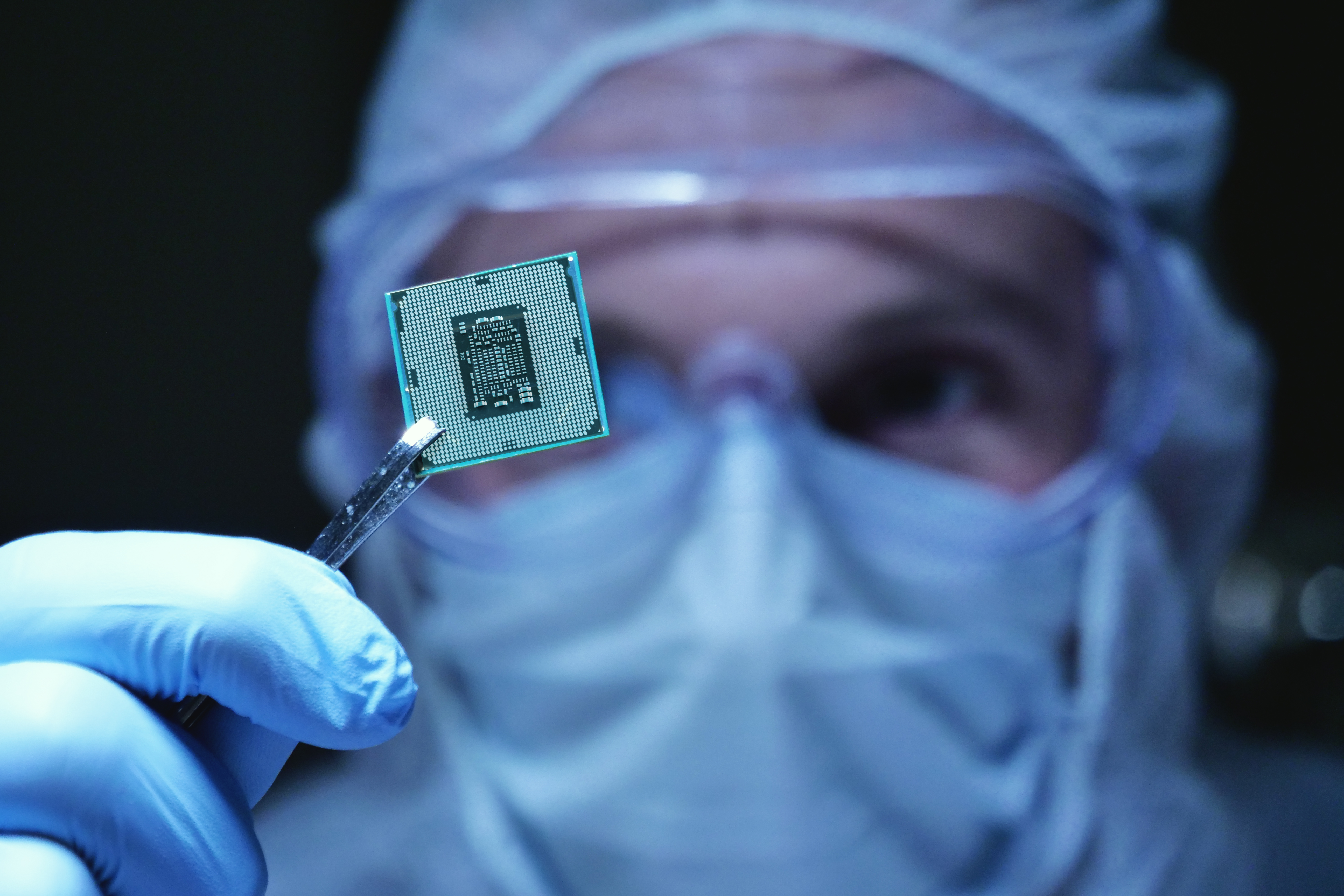

Part of what established TSMC as the global chip leader is the foundry model it pioneered. TSMC doesn't make chips that people or companies can buy online or at a retail store like typical electronics. Instead, the company makes chips designed for other companies' specific needs. It's like ordering custom-tailored clothing instead of buying something off the rack.

Check out TSMC's key financial growth:

- TSMC's revenue in the first quarter of 2024 was just over $18.8 billion, but was met with mixed reactions.

- The quarter-to-quarter drop can be attributed to the seasonality of smartphone sales.

- Investors should weather the smartphone sales slump storm as TSMC's growth will rely heavily on smartphone sales returning to more stable levels.

Regardless of how investors feel about the current state of TSMC's business, there's no denying how important it is to the entire tech ecosystem. Without TSMC and its advanced chips, there's a strong case that tech companies and their electronics wouldn't perform at their current levels.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

- The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them.

- The stock Advisor service has more than tripled the return of S&P 500 since 2002*

*Stock Advisor returns as of April 22, 2024

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.