Important Financial Indicators and Growth Initiatives from IBM's First Quarter Earnings

IBM's Q1 2024 Earnings Report:

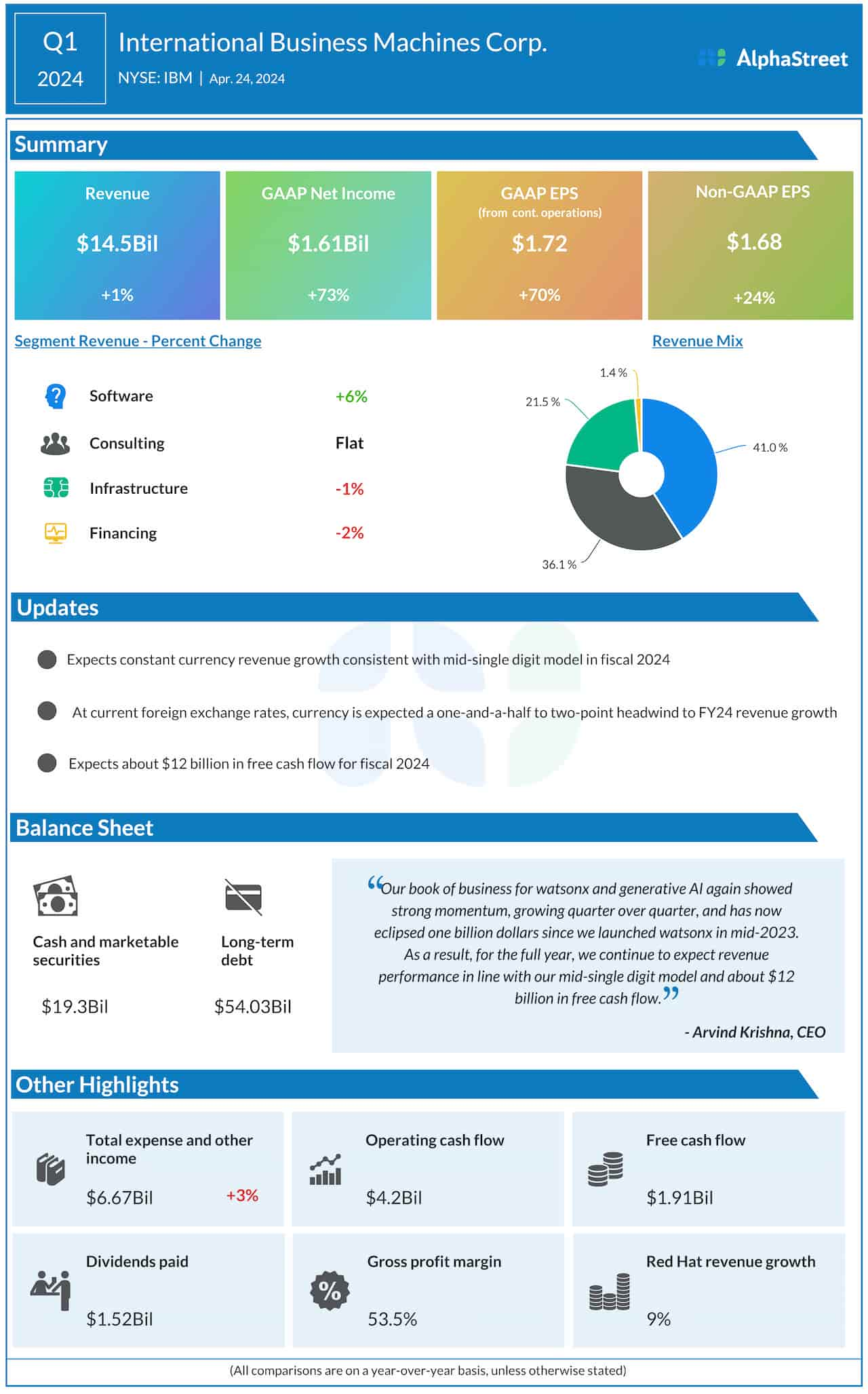

International Business Machines Corporation (NYSE: IBM) this week reported mixed results for the first three months of fiscal 2024, with earnings beating and revenues missing analysts’ estimates.

Earnings Beat:

Revenues increased to $14.46 billion in the first quarter from $14.25 billion in the prior year period but fell short of expectations. Adjusted profit from continuing operations moved up to $1.68 per share in Q1 from $1.36 per share in the first quarter of 2023.

Growth Initiatives:

- The healthy cash position will allow the business to continue investing in cloud and AI capabilities.

- IBM plans to acquire infrastructure cloud company HashiCorp for $6.4 billion to create an end-to-end hybrid cloud platform.

IBM's CEO Arvind Krishna stated, HashiCorp is a great strategic addition to our portfolio, extending Red Hat's hybrid cloud capabilities to provide end-to-end automated infrastructure and security lifecycle management.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.