Agile's Default on US$483 Million Bond Interest Payment Sparks Market Turmoil

Tuesday, 14 May 2024, 06:58

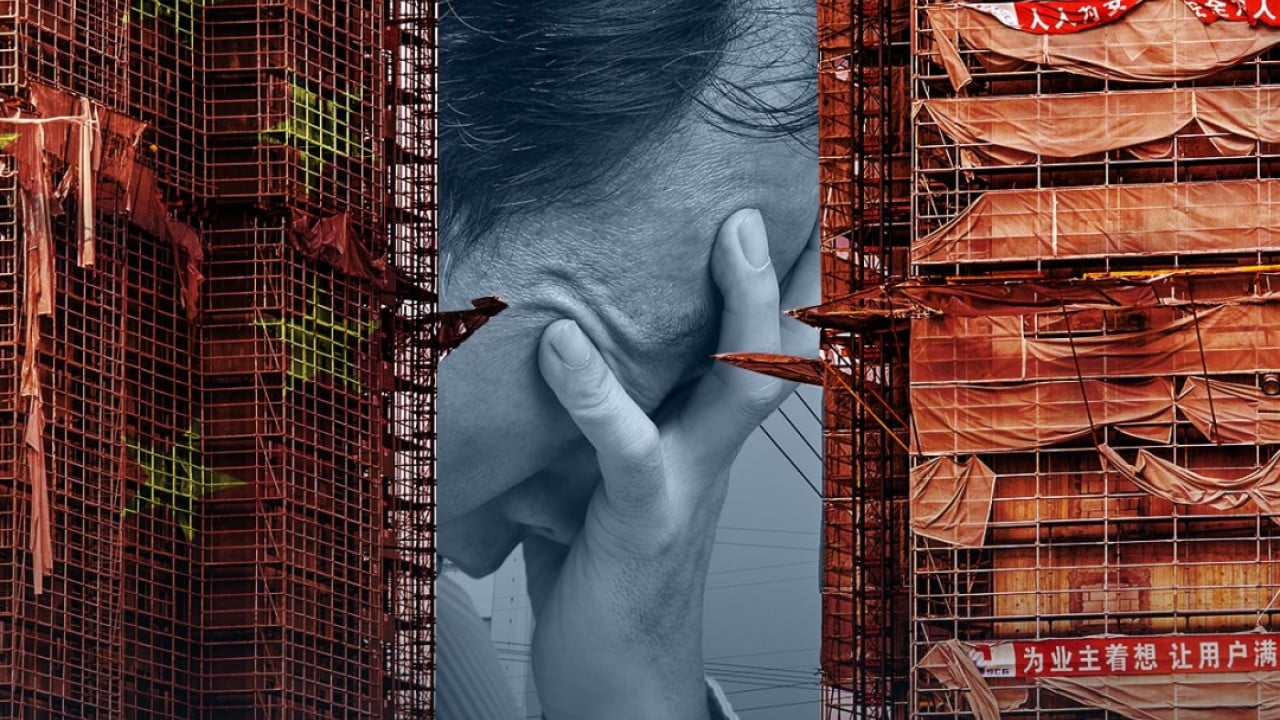

Chinese Developer's Default Sends Shockwaves

Agile, a prominent Chinese developer, recently announced its inability to fulfil all payment obligations under its offshore debts, resulting in a default on a US$483 million bond interest payment. The news has sent the company's shares plummeting and raised concerns among investors and analysts alike.

Key Points:

- Default Announcement: Agile cites liquidity pressure for its failure to meet payment obligations.

- Presales Decline: Company reports a significant 68% decrease in presales from January to April.

- Market Reaction: Shares of Agile experience a sharp decline following the default announcement.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.