BlackRock's Involvement in USTB and Its Impact on Bitcoin and Crypto Prices

BlackRock's Strategy in the Crypto Market

BlackRock is not just observing the rapid expansion of the cryptocurrency market; it is actively participating. With the approval of its bitcoin ETF, the IBIT, BlackRock is strategically entering into the evolving landscape of digital currencies.

The Role of USTB in the Crypto Ecosystem

By supporting USTB, a digital representation of the U.S. dollar, BlackRock aims to enhance market stability and attract institutional investors. This initiative could potentially reshuffle the dynamics of the crypto market, especially amidst the ongoing fluctuations in Bitcoin price.

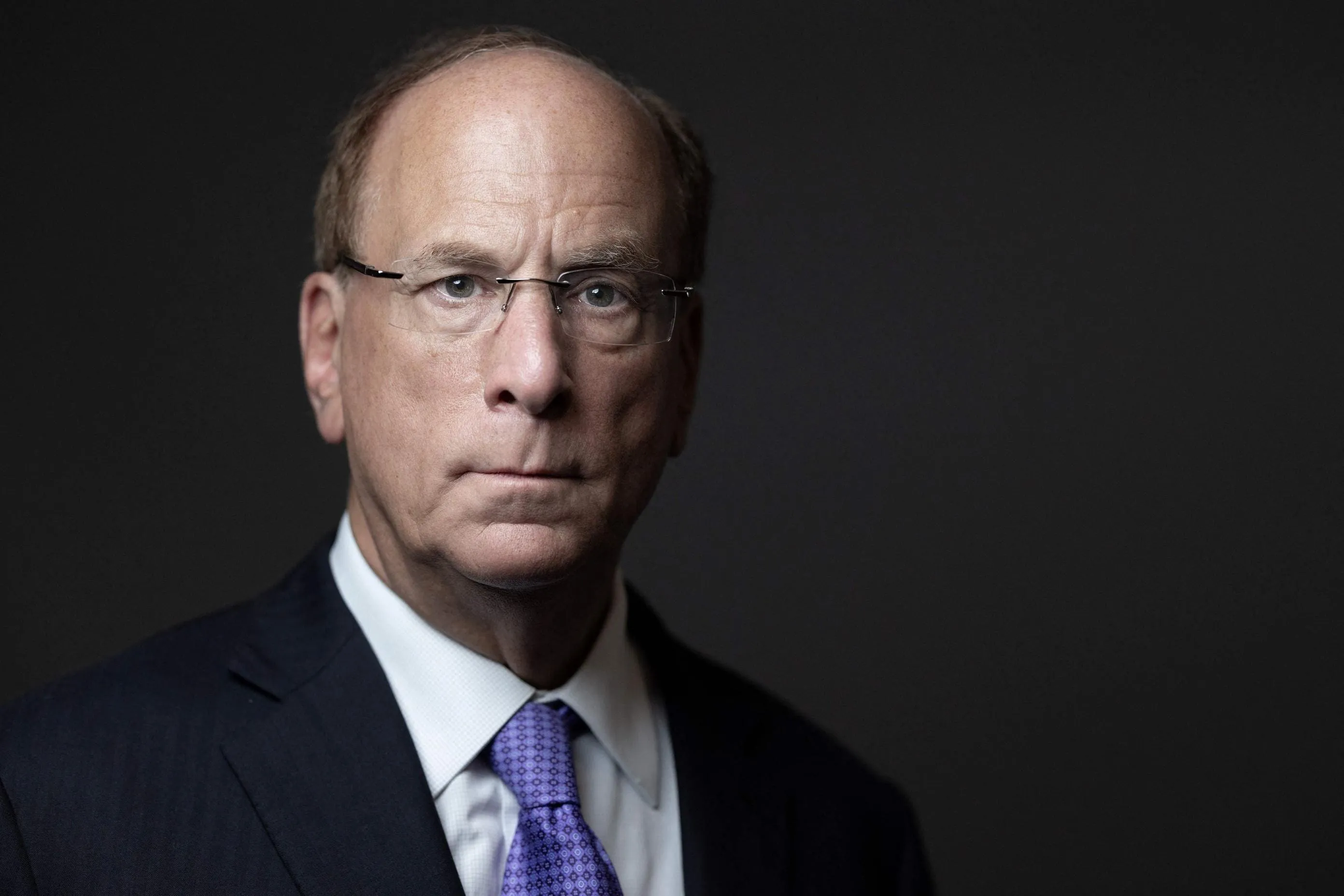

Insights from Larry Fink

Larry Fink, the CEO of BlackRock, has been vocal about the future of cryptocurrencies. His vision reflects a major endorsement of digital assets as a legitimate investment vehicle. Fink believes that cryptocurrencies, particularly Bitcoin, are here to stay, shaping the future of finance.

Conclusion: BlackRock and the Future of Crypto

As Bitcoin and crypto prices continue to soar, BlackRock's strategic interventions may set the stage for a new era in finance. Its commitment to securitize digital assets aims to integrate them into mainstream investing.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.