S&P 500: Impact of China Stimulus and U.S. Labor Market Strength on Economic Outlook

Key Drivers: China Stimulus and U.S. Labor Market

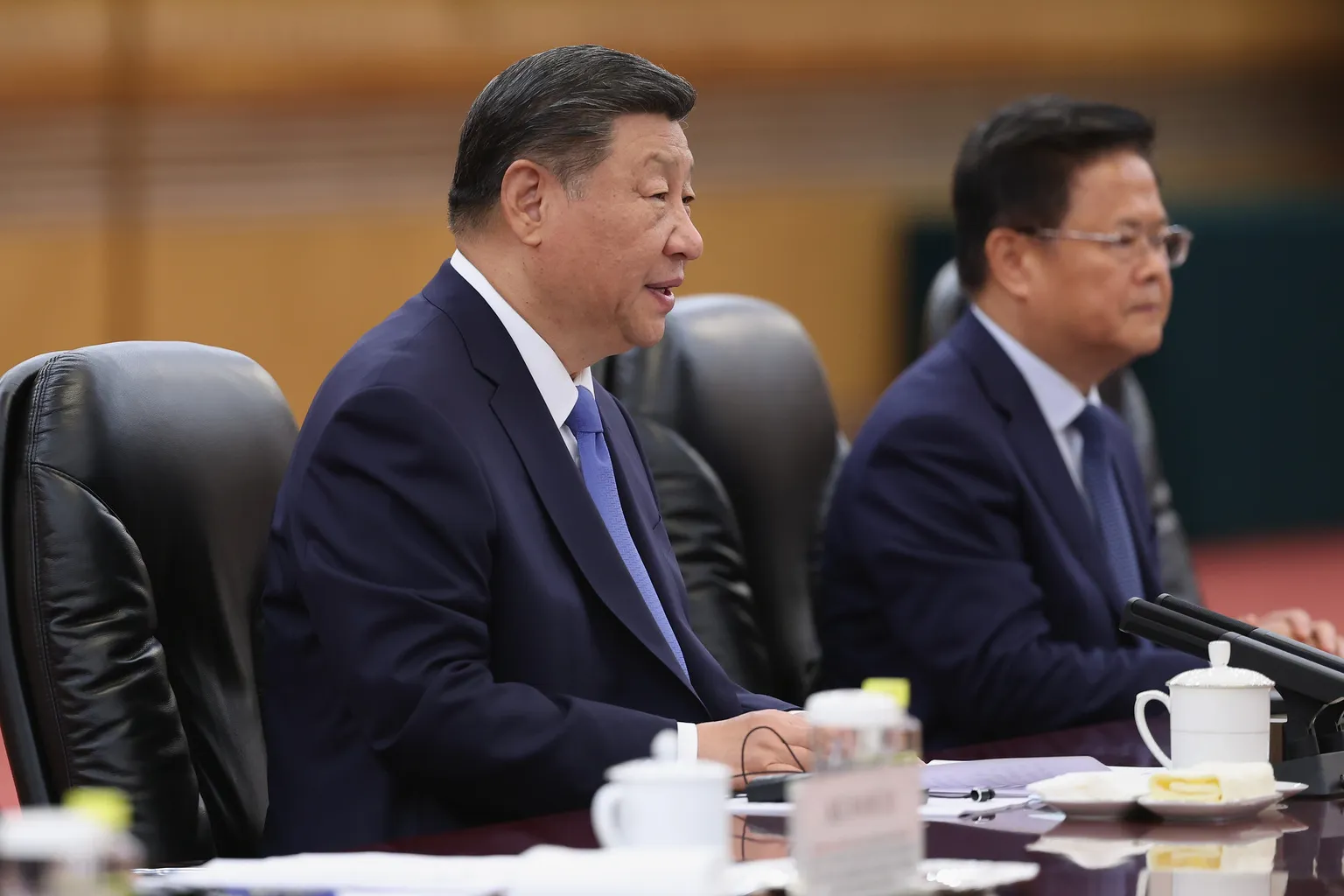

The recent China stimulus efforts, alongside a buoyant U.S. labor market, are painting a picture of resilience for the S&P 500. Analysts suggest that these factors could delay a recession and avert a significant downturn in market performance.

Implications for Investors

With this economic backdrop, investors might find new opportunities. The combination of policies in China and favorable labor statistics in the U.S. signals a potential shift in market dynamics.

- China's efforts aim to invigorate growth.

- A strong labor market fuels consumer spending.

- Averted recession allows for market stabilization.

Conclusion: An Evolving Economic Landscape

As economic indicators evolve, staying attuned to the intersection of global stimulus measures and domestic employment data will be key for navigating future market shifts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.