Money-Markets See No Sign of Investor Exit After Fed's Big Rate Cut

Record Inflows in Money-Markets

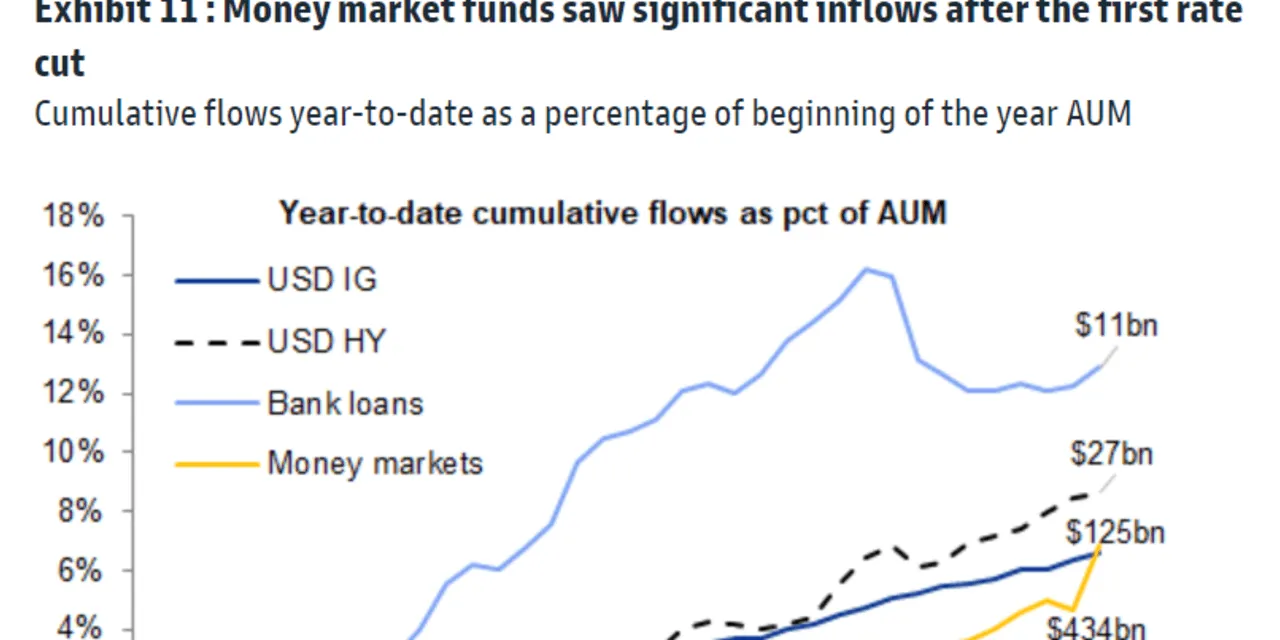

With the Federal Reserve's recent rate cut, money-markets have witnessed significant inflows. Goldman Sachs' credit research team reported:

- Inflows reached an astounding $136 billion in just one week.

- Total assets in money-market funds now stand at $6.9 trillion.

Comparison to Industry Tally

Interestingly, this total slightly surpasses the Investment Company Institute’s reported figure of $6.4 trillion for overall assets. These statistics from both sources indicate a stable and attractive environment for investors in money-markets.

The Outlook for Investors

Given this influx of investment, money-markets remain a strong choice for those seeking stability and growth. With ongoing economic uncertainties, the trend suggests that investors are flocking towards safer, liquid investment options.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.