What to Look For in Domino's Pizza Q1 Earnings Report

Wednesday, 24 April 2024, 19:01

Domino's Pizza to Report Q1 Earnings Next Week

Fast food giant Domino's Pizza, Inc. (NYSE: DPZ) is preparing to release operating results for the first three months of fiscal 2024. The world's largest pizza chain ended the last fiscal year on a high note, registering record sales volumes even as it continues expanding digital capabilities and investing in innovation.

Outlook

- Domino's to publish Q1 report on April 29, with analysts forecasting a 16% profit increase.

- Revenue expected to grow by 5% to $1.08 billion in Q1.

- Company's earnings beat estimates consistently, while revenues missed projections in the past five quarters.

Sales Trend

- Positive retention rate among franchises and consumer sentiment impacted by inflation.

- Strategic initiatives like partnerships and loyalty programs driving recent sales growth.

Key Numbers

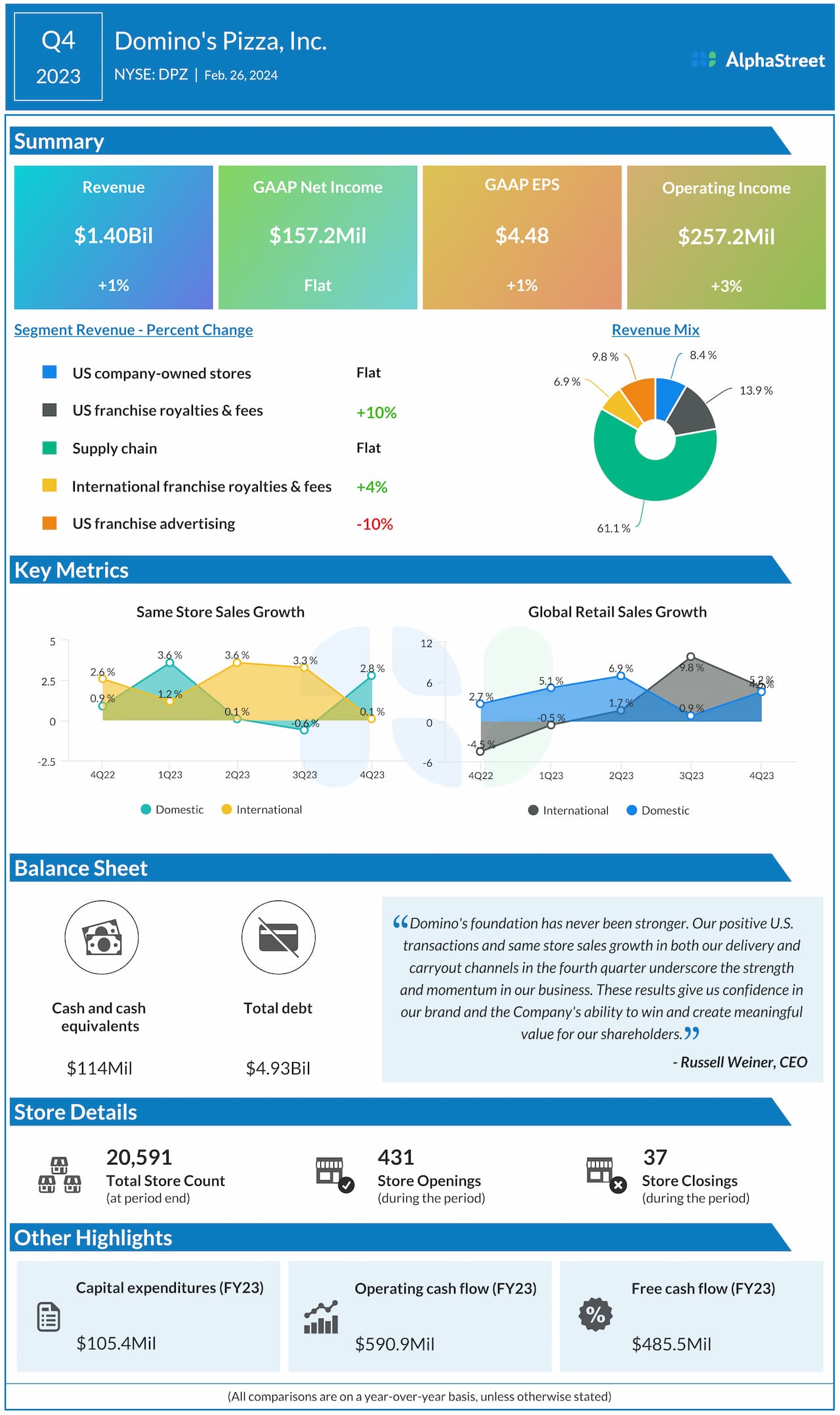

- Q4 2023 revenues slightly up at $1.40 billion, with profit rising 1% year-over-year.

- Domestic same-store sales and retail sales saw increases during the quarter.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.