Key Highlights of Hasbro's Q1 2024 Earnings Report

Results beat expectations

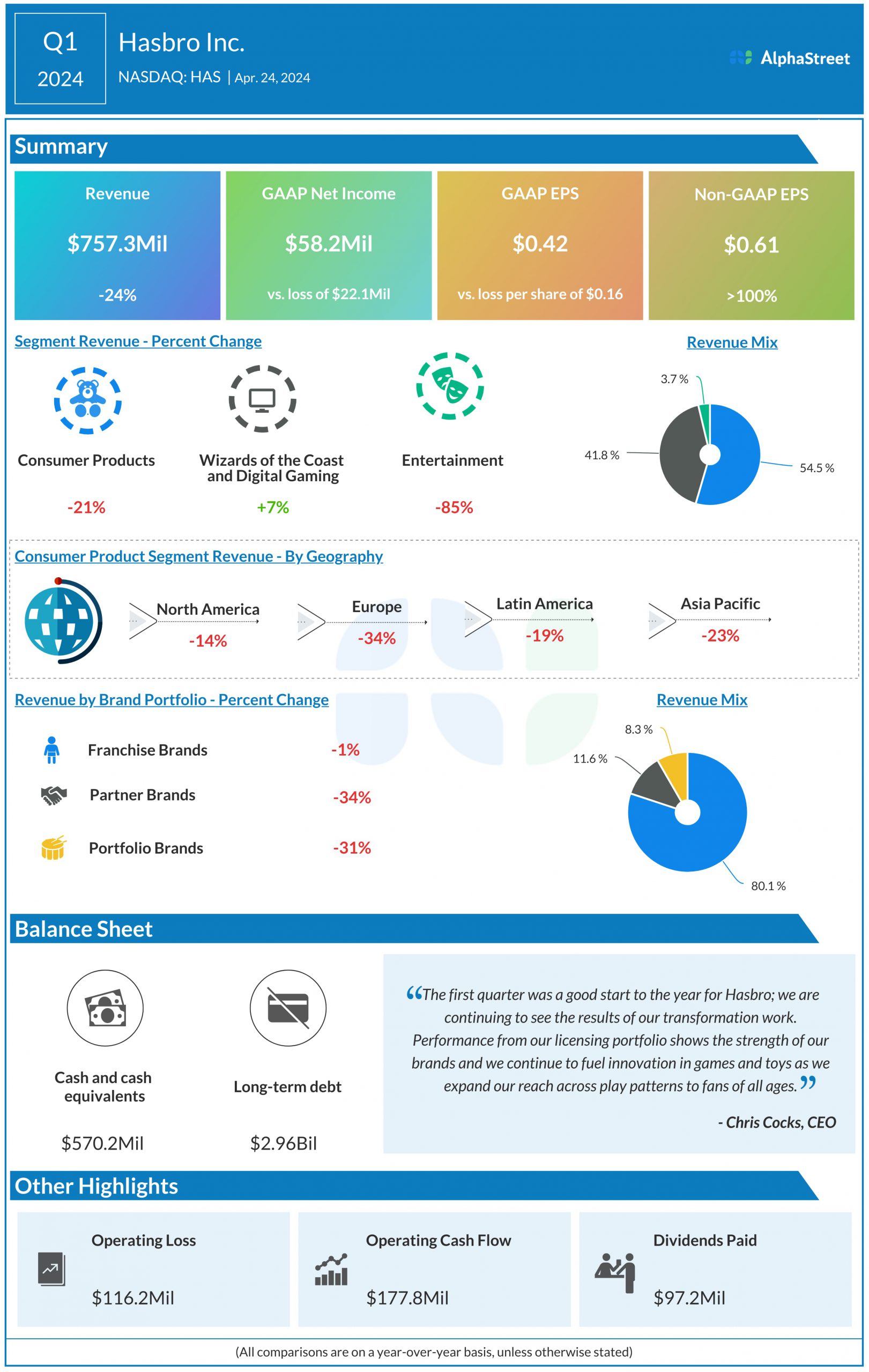

For the first quarter of 2024, Hasbro reported net revenues of $757.3 million, which declined 24% year-over-year but managed to surpass analysts’ projections of $741.2 million. Excluding the eOne divestiture, revenue decline was 9%. On a GAAP basis, earnings were $0.42 per share compared to a loss last year, with adjusted EPS at $0.61, exceeding estimates.

Category performance

In Q1, Hasbro saw a 21% revenue decline in the Consumer Products segment, driven by industry trends, exited businesses, and reduced closeout sales. Notably, Wizards of the Coast and Digital Gaming segment revenues increased by 7%, while the Entertainment segment witnessed an 85% revenue decline due to business divestiture.

Outlook

Hasbro expects Consumer Products segment revenues to decrease by 7-12% for 2024, with Wizards of the Coast segment revenue down 3-5%. Adjusted EBITDA is projected to range between $925 million to $1 billion for the year.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.