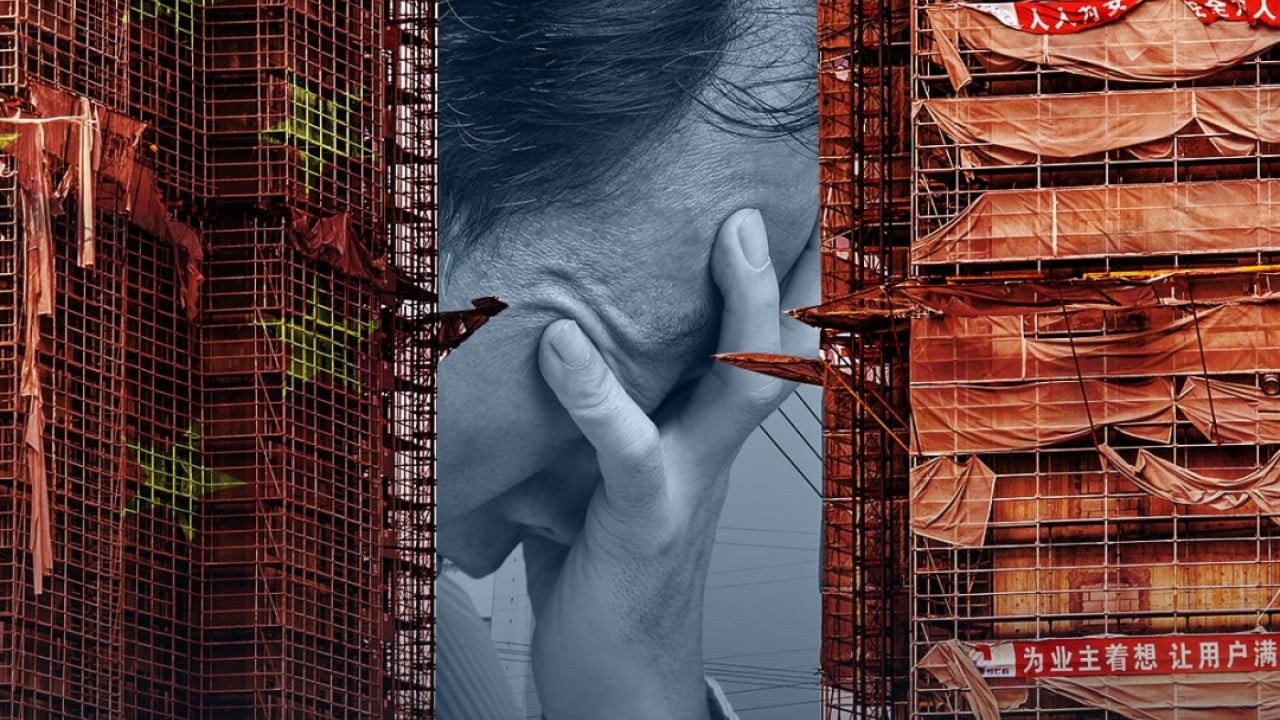

S&P Analysts Predict Potential 'Third Wave' of China Bond Defaults Due to High Financing Costs and State Policies

Tuesday, 23 April 2024, 23:00

S&P Analysts' Warning on China Bond Defaults

S&P analysts have issued a warning regarding a potential 'third wave' of corporate bond defaults in China, citing factors such as high financing costs, slow economic growth, and tightened state policies. The analysts have highlighted local government financing vehicles as particularly at risk in this challenging environment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.