Trump's Plans for Deportations, Tariffs, and Fed Policies Threaten U.S. Inflation

Trump's Economic Proposals and Their Inflationary Impact

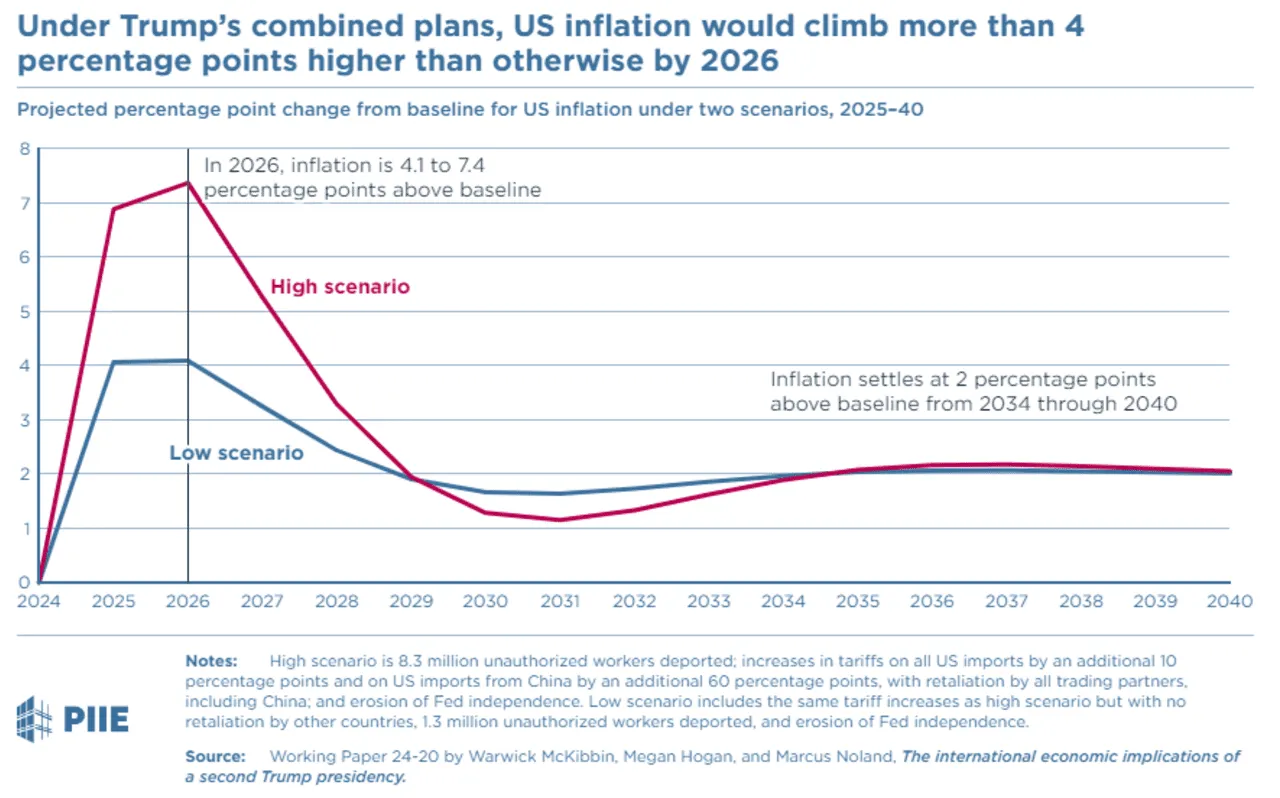

Trump's ambitious plans include increasing tariffs on imports, curbing the Federal Reserve's independence, and deporting illegal immigrants. According to economists from the Peterson Institute for International Economics, these initiatives could significantly hurt the U.S. economy by spurring inflation.

The Dangers of Increasing Tariffs

- Higher costs for consumers

- Retaliation from trading partners

- Disruption of supply chains

Impact on the Federal Reserve

- Curbing Fed independence risks loss of credibility

- Potential for misguided monetary policies

- Volatility in financial markets

Consequences of Deportations

Limiting immigration through deportations may lead to labor shortages in key industries, exacerbating inflation. With reduced workforce availability, businesses may struggle to meet demand.

Overall, Trump's proposed policies raise significant concerns for inflation rates and long-term economic performance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.