Breaking News: Markets React to Tepper's Fed Rate Cut Demand

Breaking News: Market Implications of Tepper's Fed Rate Cut Urgency

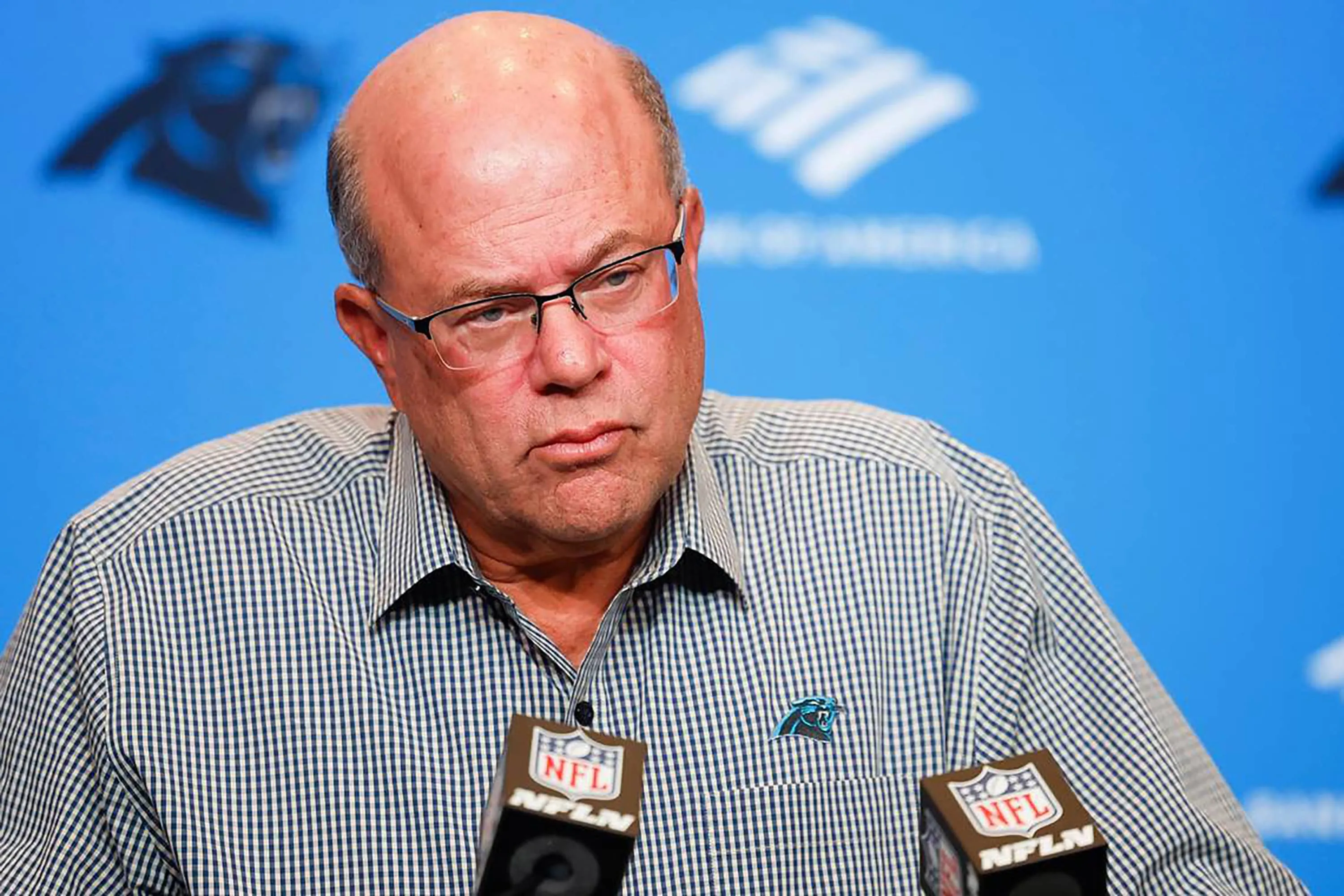

In a significant statement, Appaloosa Management's David Tepper highlights that the macro setup for U.S. stocks is increasingly concerning. He believes that the Federal Reserve must cut rates at least two or three times to sustain credibility in its monetary policy. The context of business news points toward a potentially tumultuous environment reminiscent of the 1990s, challenging investors to reassess their investment strategy.

Impacts on Wall Street and Stock Markets

- Rate cuts could spark volatility in stock markets.

- Investors must stay alert to shifting business dynamics.

- Strategic adaptation is essential given Tepper's warning.

Key Takeaways for Investors

- Monitor Fed actions closely.

- Evaluate portfolio exposure to rate-sensitive sectors.

- Consider the implications of investment strategy shifts driven by macroeconomic indicators.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.