The Potential Impact of Flat Tax Rate Rejection by President Trump

Friday, 19 April 2024, 13:11

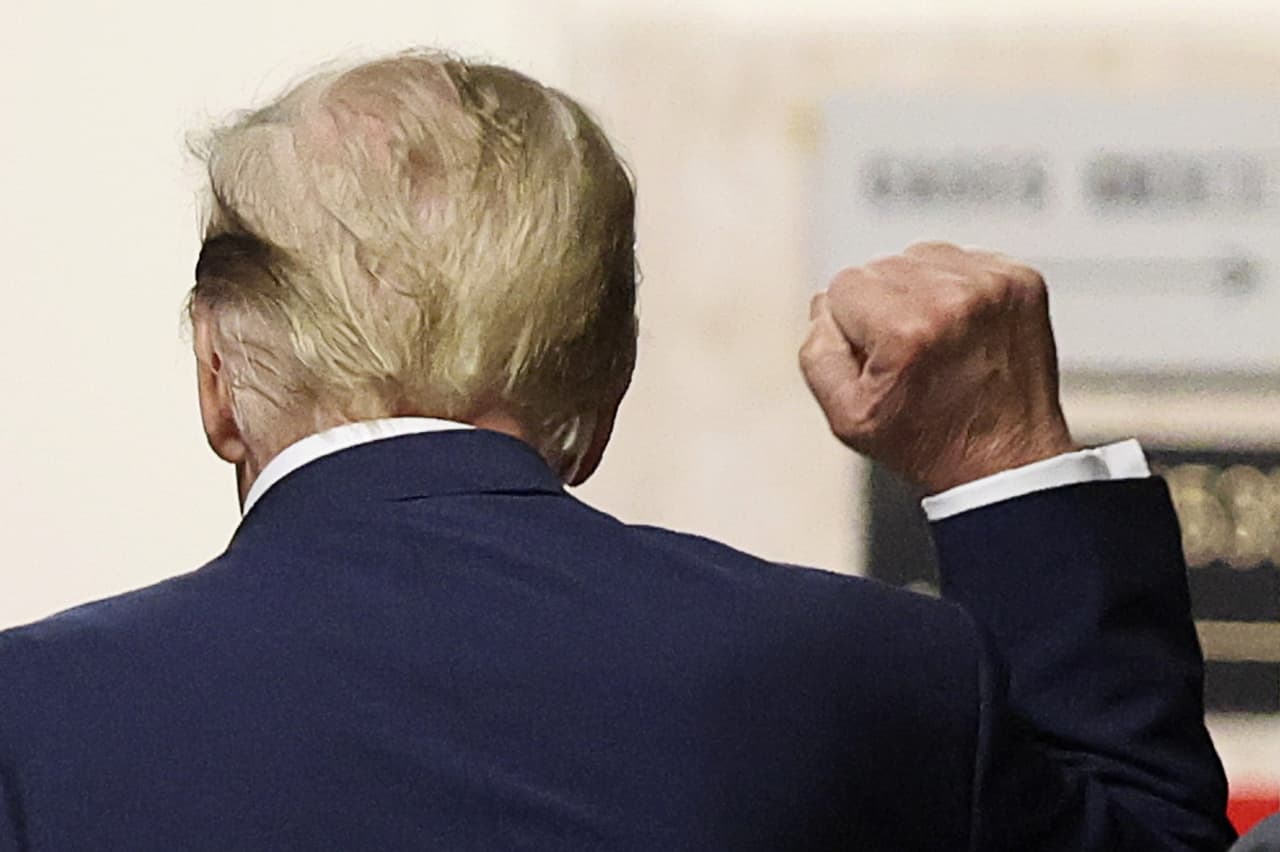

President Trump's Stance on Flat Tax Rate

A flat tax rate is one of the most debated topics in the realm of tax reform. While it may seem appealing at first glance, the ramifications of implementing such a system are far-reaching and complex.

Key Considerations:

- Equity Concerns: A flat tax rate could disproportionately impact low-income earners, raising questions about fairness.

- Economic Implications: Businesses and investors may face significant changes in their tax obligations, influencing investment decisions and economic growth.

- Political Dynamics: President Trump's rejection of a flat tax plan reflects broader political ideologies and policy priorities.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.