PepsiCo to Report Q1 Earnings: Analysis, Forecasts, and CEO Insights

PepsiCo (PEP) Q1 Earnings Preview

PepsiCo, Inc. (NASDAQ: PEP) is preparing to report first-quarter results on April 23, before the opening bell. The focus is on providing customers better value through innovation and continued investment in the brand. PepsiCo has paid dividends consistently over the past several years, with an impressive track record of increasing payouts.

Market Potential and Opportunities

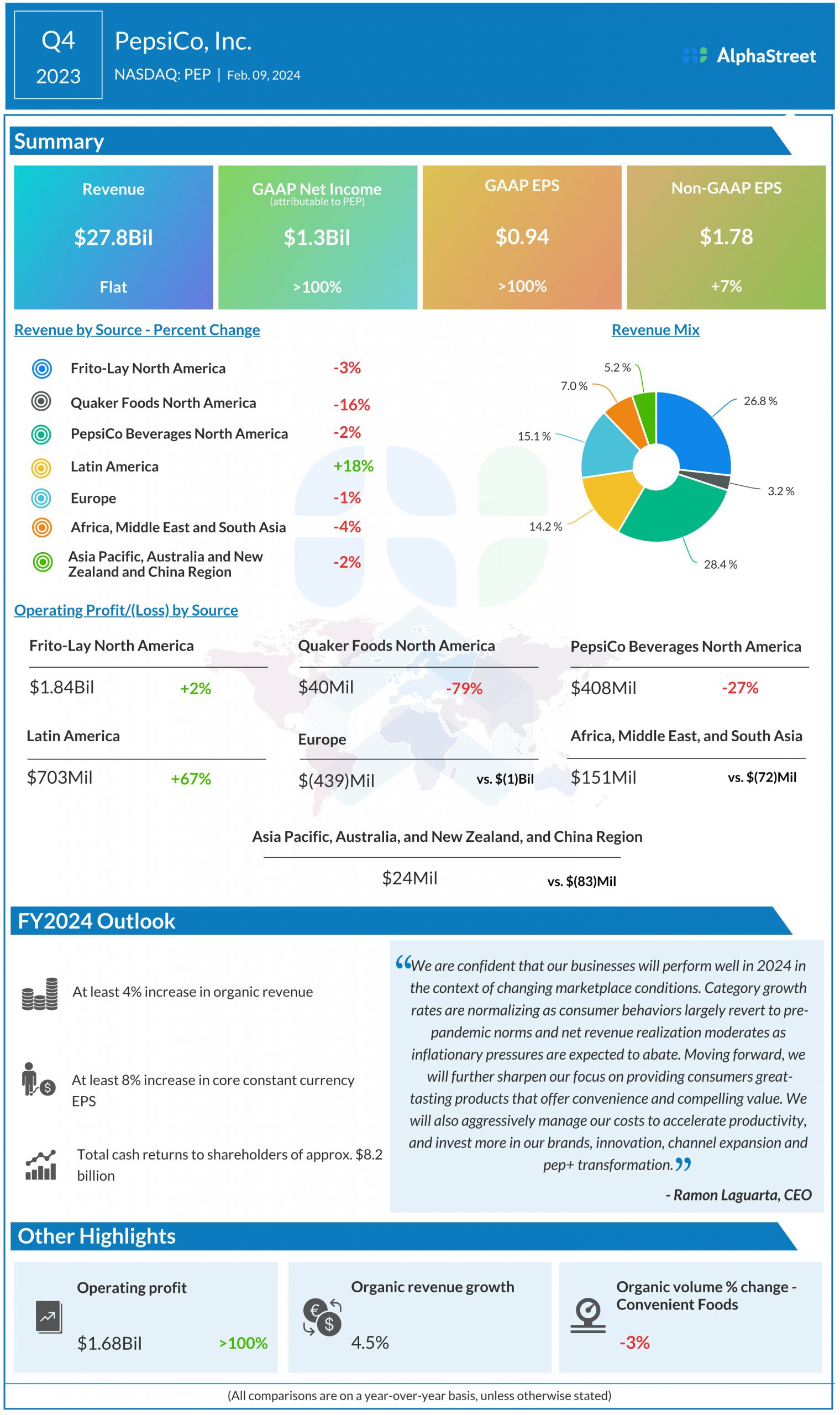

The yield is around 3% now, which is higher than the industry average. PepsiCo aims to return a total of $8.2 billion to shareholders in fiscal 2024, with a target of about 4% organic revenue growth and an 8% core constant currency EPS growth.

Q1 Financial Expectations

Wall Street anticipates adjusted earnings of $1.52 per share and a 15% jump in Q1 revenues to $18.1 billion when PepsiCo releases its results. CEO Ramon Laguarta's positive outlook and guidance further highlight the company's commitment to long-term growth.

Stock Performance and Investor Outlook

PEP is currently trading 10% below record highs, offering an opportunity for investors. Despite challenges in consumer spending, PepsiCo remains optimistic about achieving strong financial results by leveraging market improvements and recovery trends.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.