Examining the Impact of Money Supply on Bitcoin and S&P 500 Performance

Understanding the Relationship Between Money Supply and Financial Assets

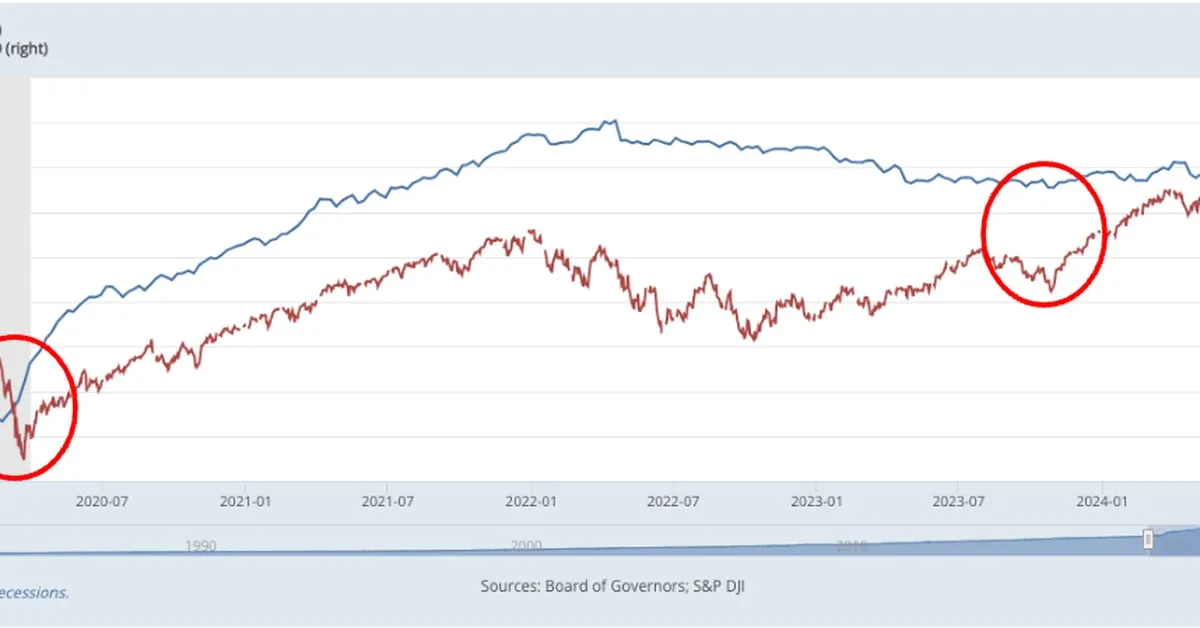

The money supply, specifically M2, has seen substantial growth, raising questions about its implications for Bitcoin and the S&P 500. This expansion signals potential investment shifts.

The Current State of the Money Supply

As the Federal Reserve pursues aggressive measures to stimulate the economy, the money supply has neared record highs. This affects liquidity in the market.

- Bitcoin has benefited from this influx, attracting speculative investment.

- The S&P 500 continues to climb as companies capitalize on the favorable conditions.

Investor Perspectives

Investors are urged to watch the trends closely, as increases in money supply could lead to surges in both Bitcoin and the S&P 500. The interplay between these financial elements could define future market directions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.