Antitrust Law and Visa: What Nancy Pelosi's Stock Sale Reveals

Antitrust Law's Impact on Financial Markets

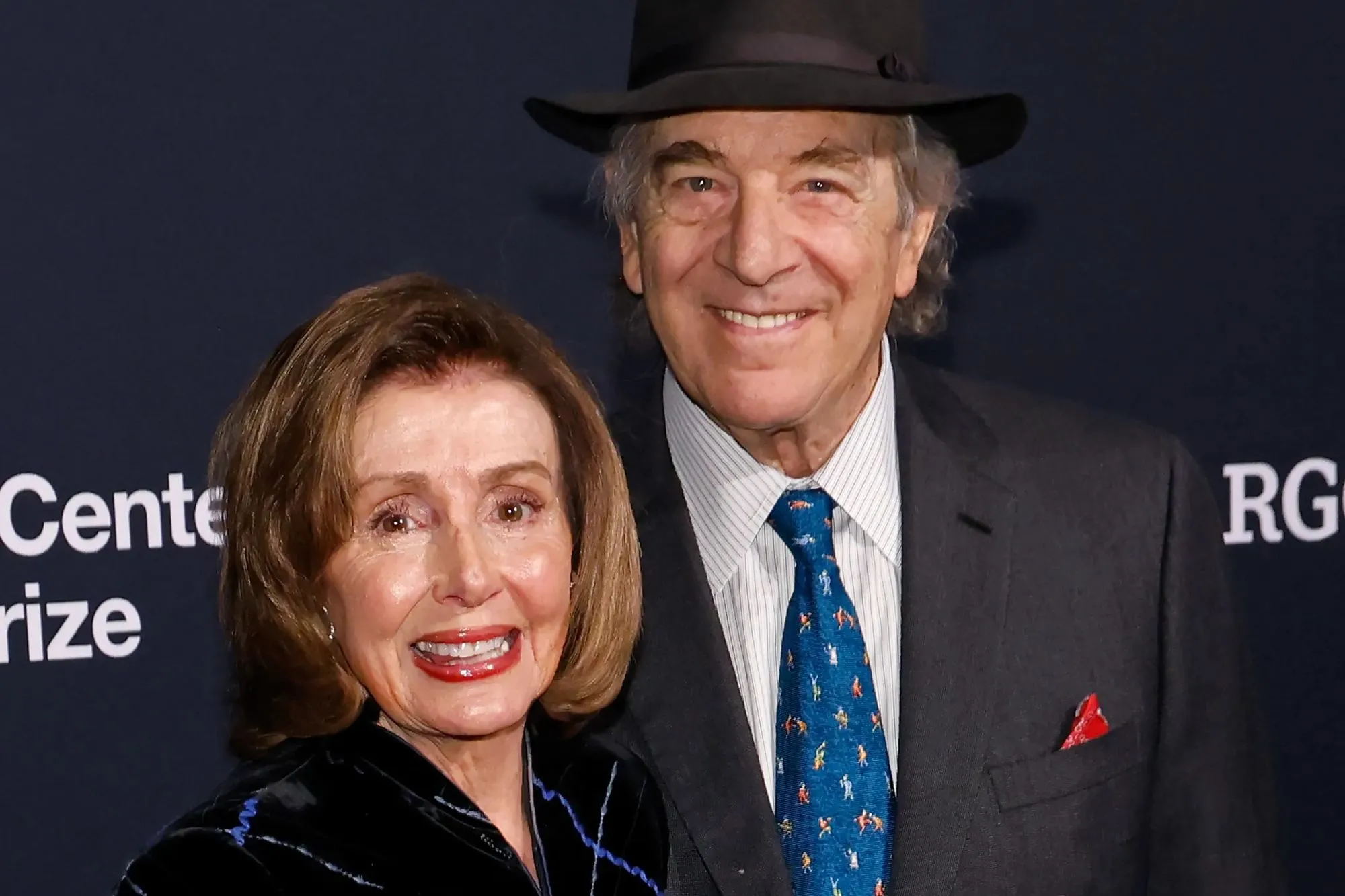

The Department of Justice is preparing to take action against Visa amid concerns over monopolistic practices in the credit card sector. Just weeks before this announcement, Nancy Pelosi's husband executed a significant stock sale, raising questions about potential conflicts of interest.

What Does This Mean for Investors?

This pending action could lead to dramatic shifts in the credit card industry, creating new opportunities and potential risks for investors.

- Increased regulatory scrutiny on major players

- Possible changes in market dynamics

- Investor sentiment likely to fluctuate

Key Takeaways

The impending lawsuit illustrates the intertwined nature of business and politics. Stakeholders must remain vigilant as developments unfold, particularly regarding credit cards and antitrust implications.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.