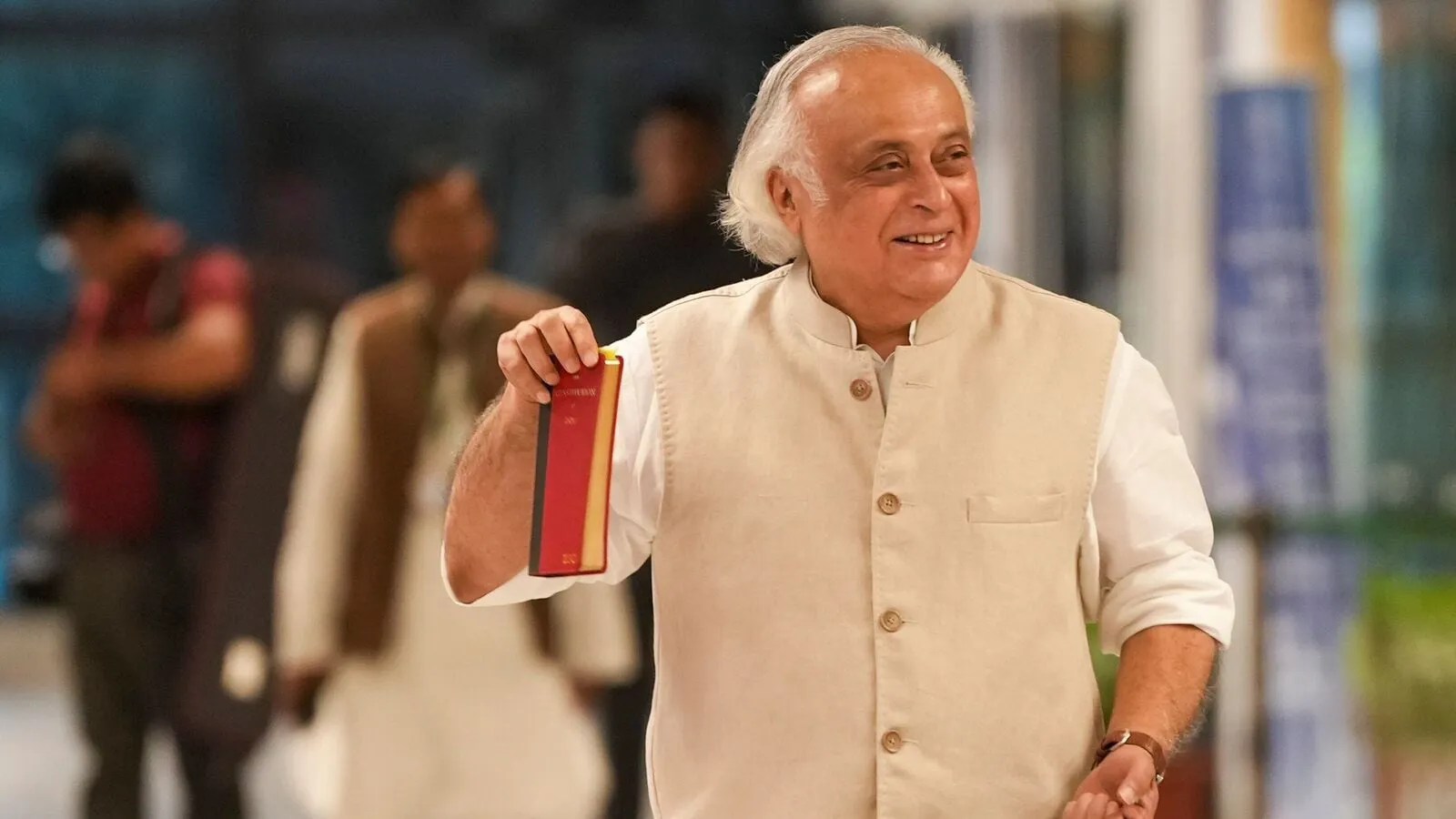

Business News: Jairam Ramesh Urges RBI to Investigate SBI's Stakeholding in Supreme Infrastructure India

Jairam Ramesh Raises Alarm on SBI's Stakehold in Supreme Infrastructure

The Indian National Congress (INC) on September 24 has raised alarms concerning the State Bank of India (SBI) converting its outstanding debt into equity in Supreme Infrastructure India Limited (SIIL). Congress leader Jairam Ramesh emphasized the need for the Reserve Bank of India (RBI) to intervene and scrutinize SBI's decision.

Concerns Over SBI's Decision

In a striking post on social media platform X, Ramesh emphasized that this decision could set a dangerous precedent for corporate debt management in India. He noted that the lenders, including SBI, accepted a 93.45% loss on the debt, which could encourage other defaulting companies to pursue similar arrangements.

- This move allows defaulting firms greater control despite their financial failures.

- Ramesh highlighted the potential risks it poses to the integrity of India’s insolvency framework.

- There is a pressing need for public sector banks to prioritize the recovery of public funds.

Need for Regulatory Scrutiny

Ramesh stated the alarming nature of SBI's dual role as both creditor and equity stakeholder, requesting immediate regulatory scrutiny. He urged the RBI to assess SBI's processes, emphasizing the necessity of maintaining discipline in debt resolution to prevent moral hazards in the financial landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.