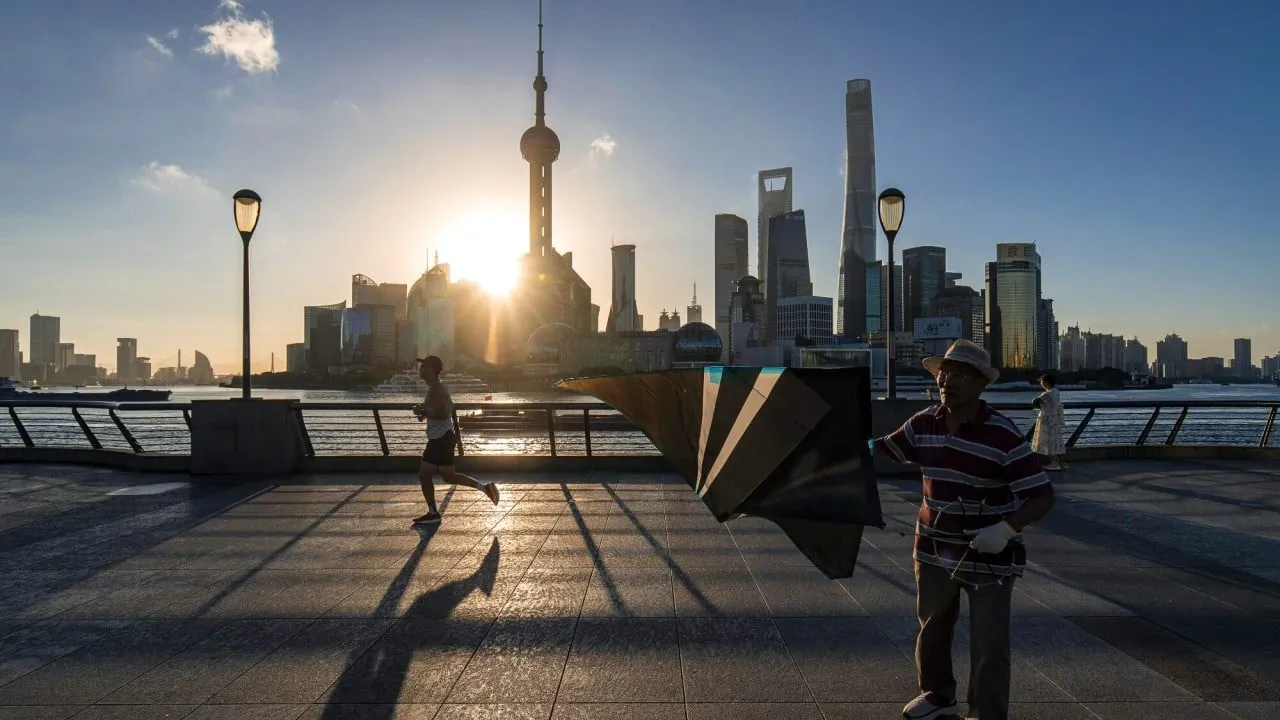

PBOC's 500 Billion Yuan Swap Facility Aims to Boost China’s Beleaguered Stock Market

PBOC's Initiative to Support the Stock Market

The People’s Bank of China (PBOC) has announced a groundbreaking 500 billion yuan swap facility aimed at providing non-bank financial institutions access to funds for purchasing shares, in an effort to stabilize the beleaguered stock market. This unexpected measure is intended to foster a market rebound after years of declines.

Details of the Swap Facility

- Governor Pan Gongsheng detailed that brokers, mutual funds, and insurers can leverage existing shares as collateral.

- Success of the initial program could lead to an additional 500 billion yuan in liquidity directed toward mainland markets.

In collaboration with Wu Qing, chairman of the China Securities Regulatory Commission, the PBOC is contemplating additional funding rounds should this strategy prove effective.

Impact on the CSI 300 Index

The CSI 300 Index has suffered due to property market woes and fears of a deflationary spiral, dropping over 6% this year alone. However, recent measures prompted a 4.3% increase in the index upon announcement.

Broader Market Measures

- The PBOC has also implemented a series of stimulus measures targeting the property sector.

- A cut in the reserve requirement ratio and mortgage rates aims to increase consumer confidence.

- Additional support includes a 300 billion yuan special relending program for share repurchases.

Although these steps have generated optimism, some analysts, including Dai Ming from Huichen Asset Management, argue that significant challenges remain as these policies may not be enough to turn the market trend around.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.