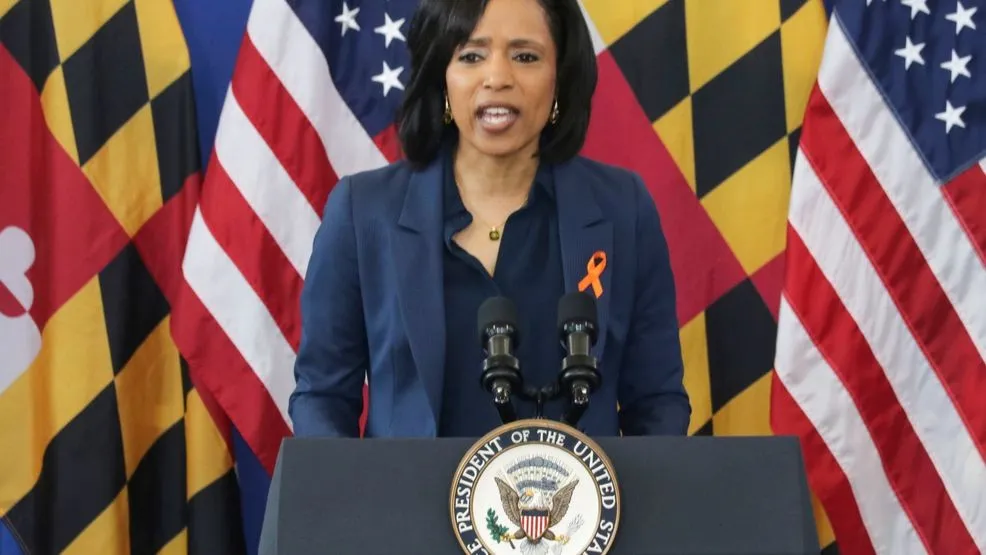

Angela Alsobrooks Investigated for Improper Tax Breaks in Prince George’s County

Angela Alsobrooks and Tax Breaks

Angela Alsobrooks, the Senate candidate and Prince George’s County Executive, is currently facing scrutiny after it was revealed that she potentially improperly benefitted from tax breaks. The tax breaks in question are linked to the homestead tax credit, which is designed to assist homeowners by offering tax exemptions based on property values.

Implications for Property Values and Financial Responsibility

This situation raises serious questions about property values and the overall financial responsibility of elected officials. The Maryland Department of Assessments is reportedly examining the circumstances surrounding these benefits. As property values continue to fluctuate, the need for transparency in financial matters becomes increasingly urgent.

Key Takeaways

- Angela Alsobrooks admits to benefitting improperly from the homestead tax credit.

- Concerns are rising regarding the impact of her actions on property values in the county.

- The scrutiny may lead to a broader discussion about tax exemptions in Maryland.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.