Emerging Markets Drive Clean Energy Investment: GIC and Quebec Pension's Strategic Backing

Emerging Markets and Clean Energy: A New Era

In a bold move, Brookfield Asset Management has successfully raised an initial $2.4 billion for a fund that focuses on investing in clean energy and transition assets within emerging markets. This funding is part of a broader strategy to address climate change while generating substantial wealth for investors.

A Significant Commitment

- This fund is approximately halfway to reaching its total goal of $5 billion.

- Strategically positioned in markets like Singapore, the fund aims to capitalize on sustainable business growth.

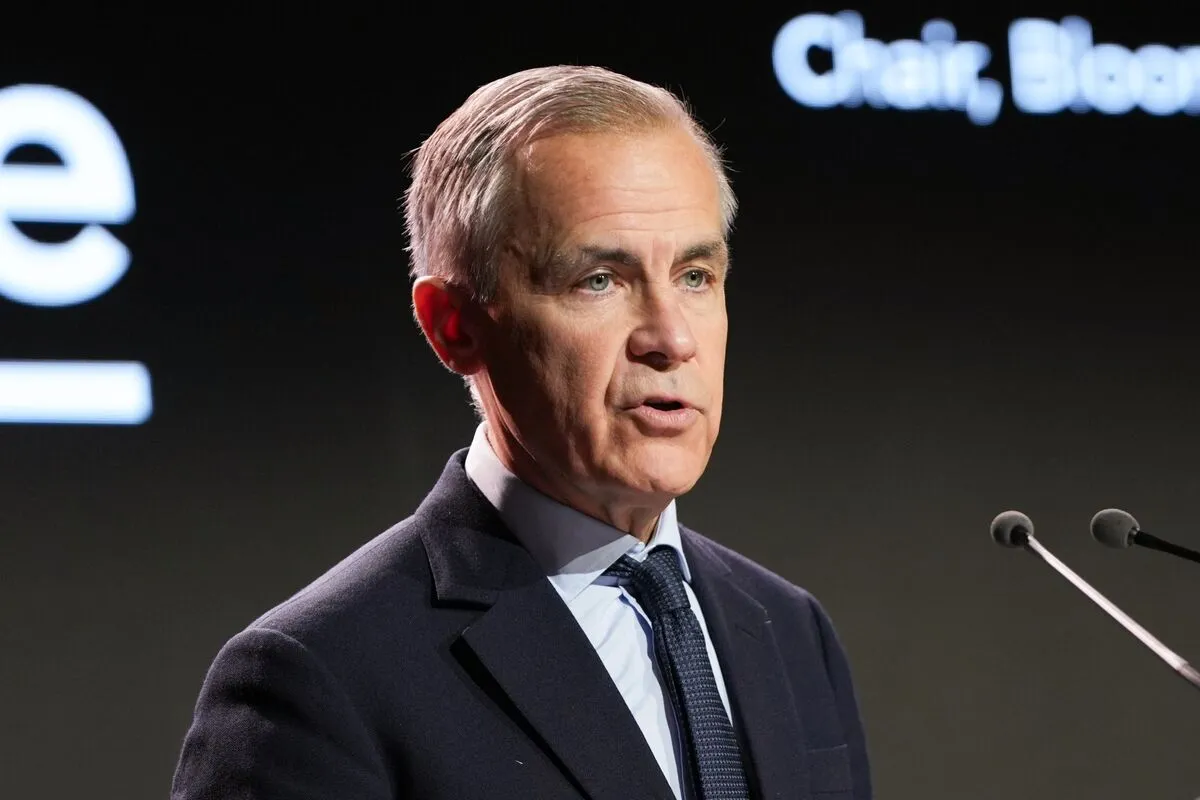

- Mark Carney’s vision shapes the fund's direction, promoting investment in green initiatives.

Implications for Investors

- Investing in clean energy offers both promising returns and a chance to combat climate issues.

- The fund aligns with increasing global demand for sustainable practices and products.

For further details on this exciting investment opportunity in emerging markets, please inquire about the ongoing developments surrounding Brookfield's initiative.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.