Centuri Holdings Initiates IPO to Expand and Become Independent Entity

Centuri Holdings Takes the IPO Route to Expand

Utility infrastructure service provider Centuri Holdings, Inc. has initiated an initial public offering as it seeks to spin off from parent company Southwest Gas Holdings and become an independent entity. On completion of the offering, there will be about 86.66 million shares outstanding, valuing Centuri at $1.8 billion.

Proceeds

The Centuri leadership plans to use $150 million of the net proceeds from the offering and concurrent private placement to repay debts and utilize the remainder for general corporate and working capital purposes. Post-IPO, Southwest Gas Holdings will continue to own a significant portion of Centuri's outstanding common stock.

The Company

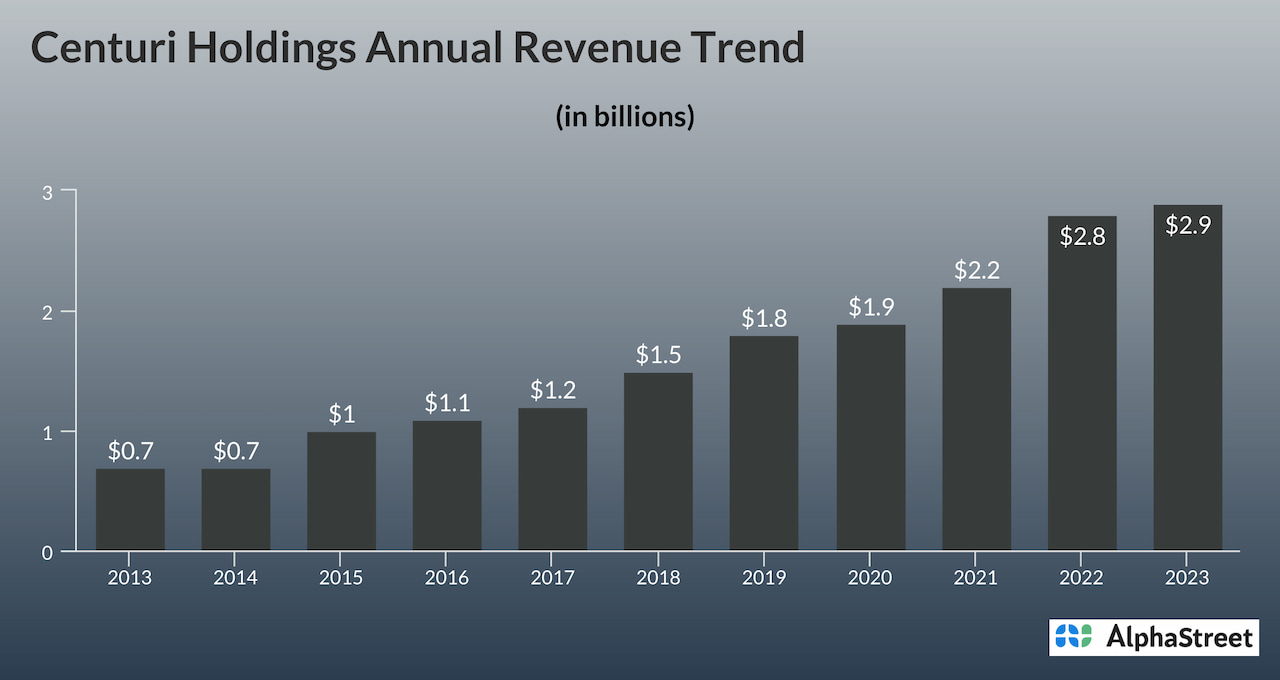

Centuri is an infrastructure services company serving regulated utilities in building and maintaining energy networks. With more than 12,000 employees, the company, led by CEO William Fehrman, has shown growth through organic expansion and acquisitions since its formation in 2014.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.