Affordable Housing in California: Can Fed Fix the Market?

Current State of Affordable Housing

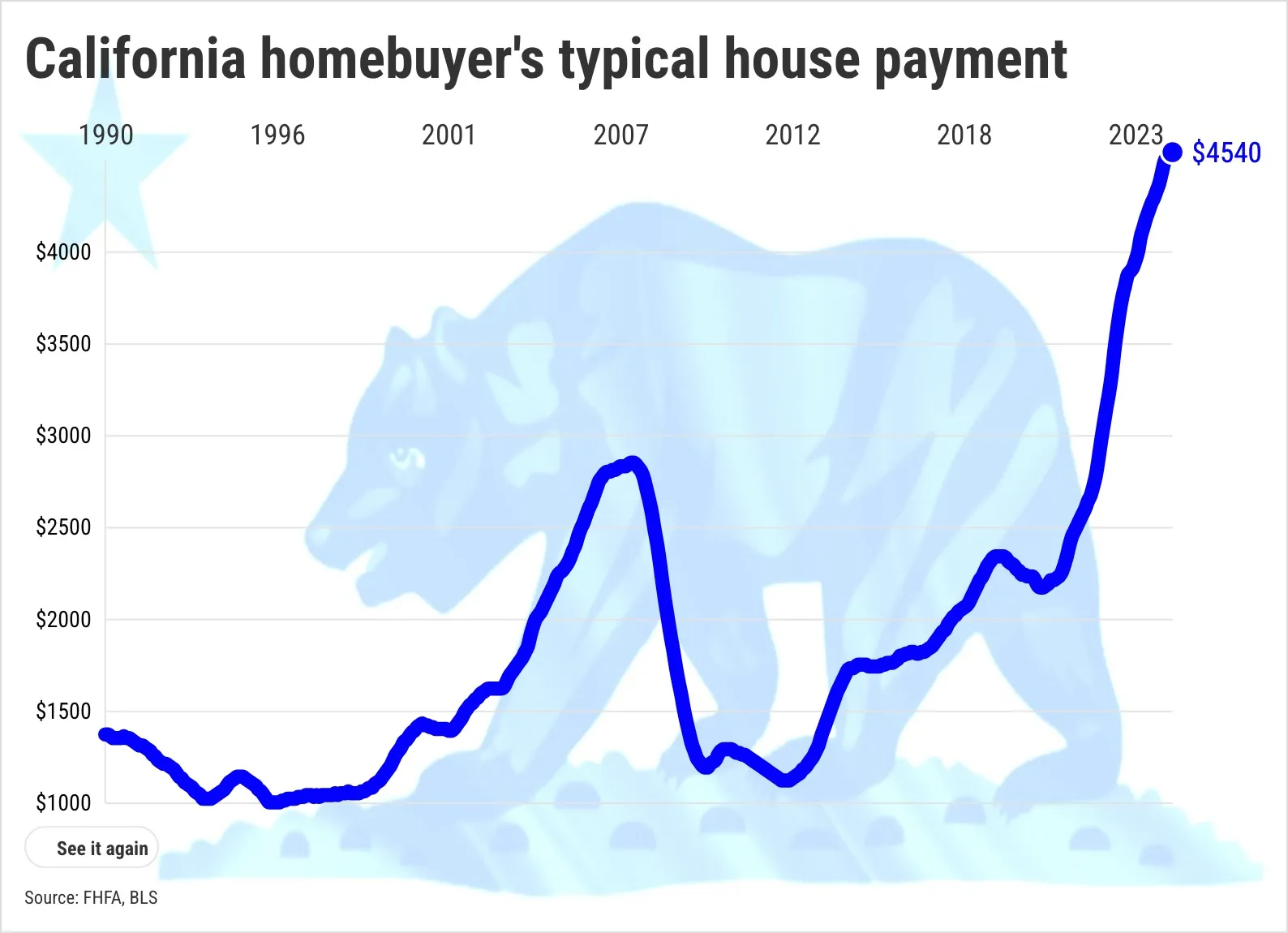

California's affordable housing dilemma has intensified, with home sales falling to a troubling annual rate of 260,200. This decline surpasses the lows witnessed during the 2008 financial crisis and the mid-1990s real estate downturn. Such trends raise significant concerns about the availability and accessibility of affordable housing in the state.

Possible Federal Interventions

The Federal Reserve has been scrutinizing ways to address the ongoing real estate challenges. Policy interventions that focus on economic stimulation might be pivotal in restoring confidence in the housing market.

Key Strategies

- Interest Rate Adjustments: Lowering rates may encourage buyers.

- Liquidity Support: Providing backing for mortgage lenders can enhance access.

- Community Investments: Characterizing local infrastructure improvements may incentivize new developments.

Nevertheless, the effectiveness of these strategies remains uncertain amidst fluctuating economic conditions.

Conclusion: Future of Affordable Housing

In conclusion, the Fed faces considerable challenges ahead. Its actions will critically shape the trajectory of the affordable housing market in California. Continued analytical measures and strategic implementations will be necessary to navigate the obstacles ahead.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.