Comparing VanEck and iShares Semiconductor ETFs for Optimal Investor Returns

Comparing the ETFs and components

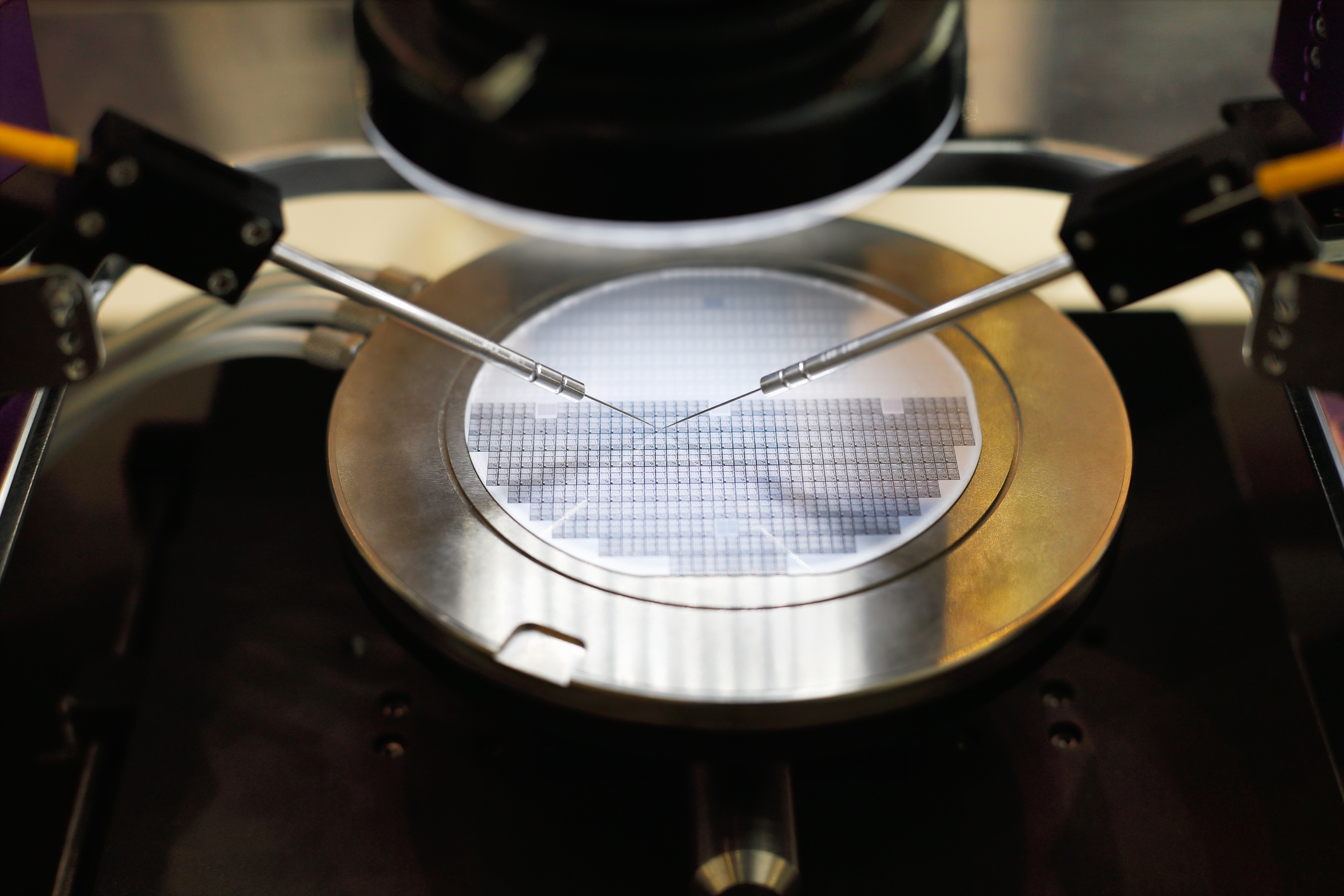

Both VanEck and iShares Semiconductor ETFs offer an expense ratio of 0.35% and feature Nvidia as a top holding. VanEck favors semiconductor stocks related to manufacturing, prominently holding TSMC and ASML, while iShares has a broader selection of 30 stocks.

Differentiating factors

VanEck's heavier focus on manufacturing stocks and aggressive positions in key companies like Nvidia and TSMC have contributed to its superior returns compared to iShares over various time horizons.

Considering these factors, the VanEck Semiconductor ETF emerges as a more lucrative option for investors seeking robust performance in the semiconductor sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.