Bitcoin Could Surge Amid Looser Financial Conditions: What You Need to Know

Bitcoin's Surge and Financial Condition Dynamics

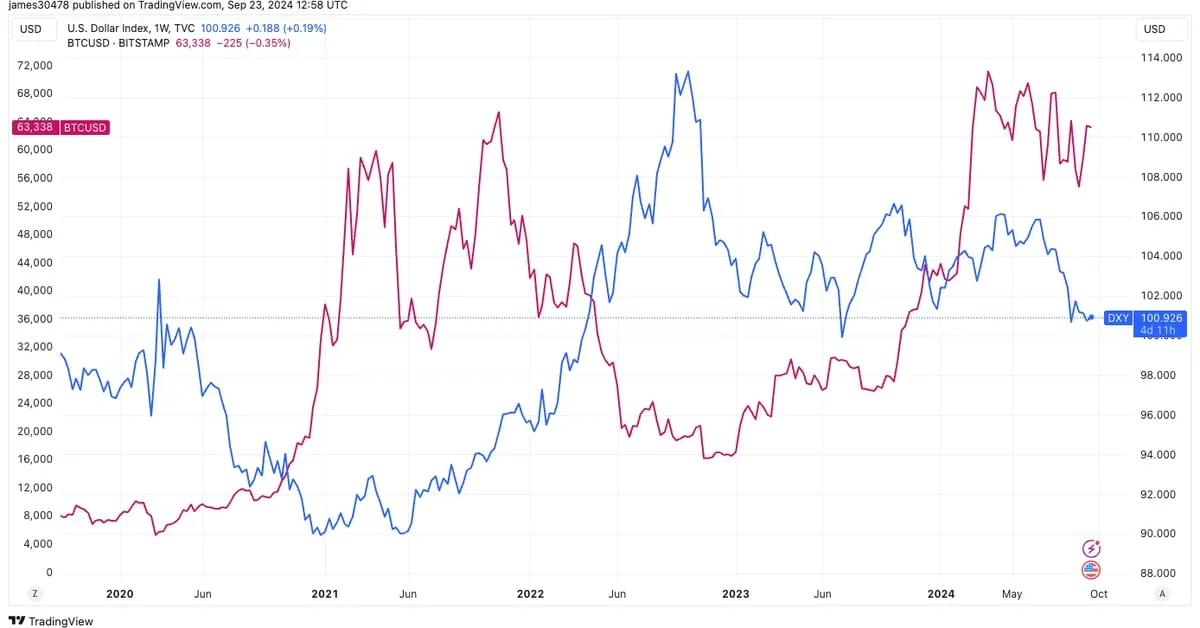

As financial conditions loosen globally, Bitcoin emerges as a prime candidate for potential gains. The Chicago Fed's NFCI indicates the most relaxed influences on financial conditions since 2021. The implications of this trend could lead to remarkable price movements in the cryptocurrency landscape.

Market Impact of Financial Easing

Looser financial conditions often translate to wider opportunities for assets like Bitcoin. With increased liquidity, investors may shift focus toward cryptocurrencies, igniting interest and demand.

Factors Contributing to Bitcoin's Bullish Trend

- Increased liquidity in financial markets

- Historical correlation between easing and Bitcoin prices

- Growing institutional interest in cryptocurrencies

Investor Sentiments and Future Outlook

As market sentiments shift with financial policies, the outlook for Bitcoin remains optimistic. Investors should monitor financial conditions closely as they can significantly influence market trajectories.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.