USD/JPY Technical Analysis: Insights and Predictions from Banks

USD/JPY Technical Analysis and Market Outlook

The latest technical analysis of the USD/JPY currency pair shows that banks believe the critical resistance level at 145.50 will likely be breached. There is a prevailing momentum favoring the US Dollar, driven by various economic factors.

Key Factors Influencing USD/JPY

- Economic indicators from the U.S.

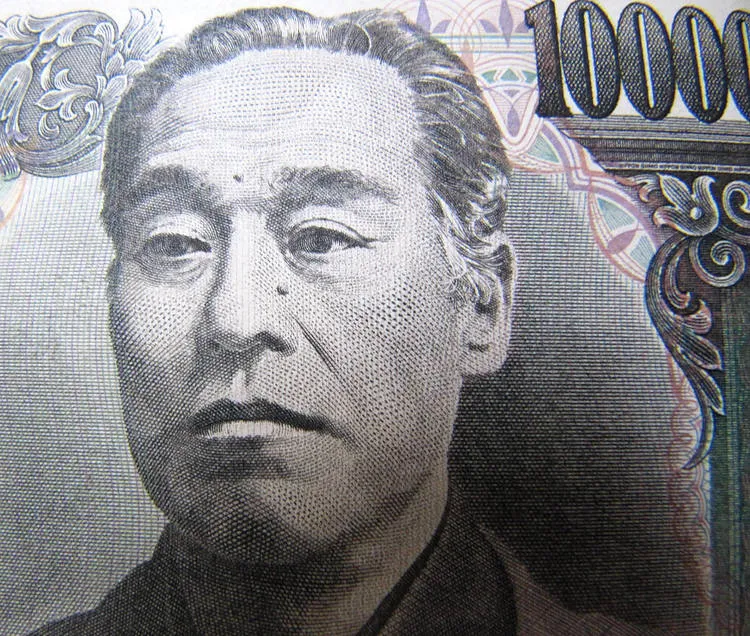

- Japanese monetary policy adjustments

- Market sentiment and investor behavior

Analysts are closely monitoring these elements as they determine the trajectory of the USD/JPY pair. If the momentum continues, a sharp advance in USD could position it squarely against the resistance level.

Insights from Banks on Future Movements

Financial institutions suggest that for traders, understanding the technical analysis around USD/JPY is essential due to its implications on trading strategies.

Current sentiment and analysis lead us to believe that the resistance at 145.50 is unlikely to hold. Investors should prepare for potential price movements in this currency pair.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.