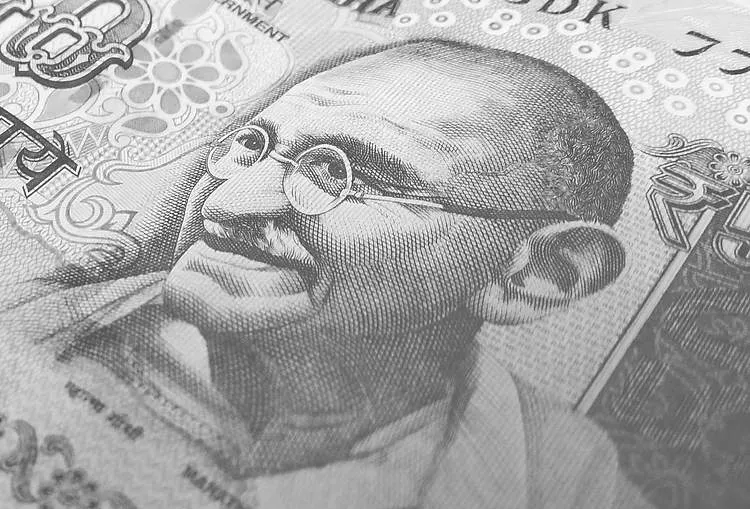

USD/INR Dynamics: Understanding India's Currency Amid Market Caution

Monday, 23 September 2024, 02:09

Macro Trends Impacting USD/INR

The USD/INR currency pair reflects significant macroeconomic trends in India. Investors should monitor emerging markets as they are crucial in this context.

Foreign Inflows and Their Effects

- Robust foreign inflows boost the INR, stabilizing it against fluctuations.

Oil Prices: A Double-Edged Sword

- Higher crude oil prices can limit the INR's potential growth.

- Stronger USD signals market caution and necessitates investor vigilance.

In summary, the USD/INR scenario emphasizes the need for watchfulness in investment strategies amid significant macroeconomic factors.

Key Takeaways for Investors

- Monitor USD strength as it impacts USD/INR rates.

- Be aware of geopolitical factors affecting oil prices.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.