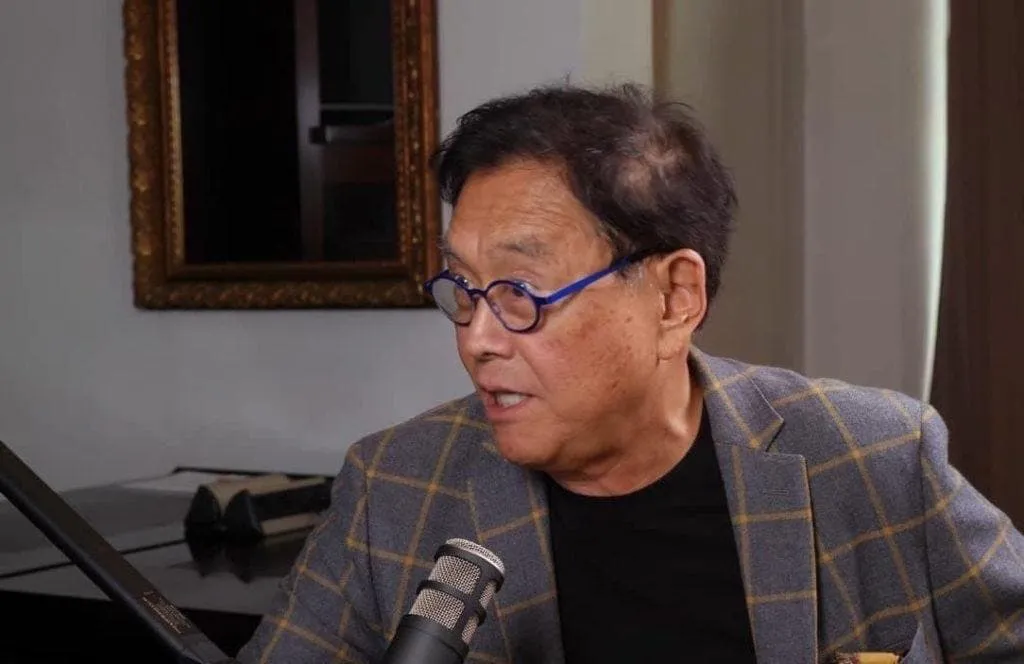

Bitcoin Predictions: Robert Kiyosaki’s Bold Forecast for BTC in the Coming Years

Bitcoin Predictions: Kiyosaki's Economic Insights

Amid uncertain times for the global economy, prominent investor and author of Rich Dad Poor Dad, Robert Kiyosaki, forecasts Bitcoin (BTC) is a key asset for wealth preservation. He predicts it will skyrocket to $500,000 in 2025 and escalate to $1 million by 2030. Kiyosaki emphasizes the transformation of finance due to artificial intelligence (AI) and recommends studying Jim Rickards' upcoming book, MoneyGPT.

Kiyosaki on Cashflow and Trends

In the current economic landscape, Kiyosaki sees a significant shift towards Bitcoin as investors search for stability against traditional financial systems. He previously mentioned that real assets like Bitcoin, gold, and silver will rally as the Federal Reserve revises its monetary policies. He believes that as public concern for fake assets increases, the demand for real alternative investments will rise.

- Key Predictions:

- Bitcoin to reach $500k by 2025.

- Potential for BTC to hit $1 million by 2030.

- AI's influence on monetary systems.

- Shift towards real assets from traditional investments.

Investment Strategies for the Future

Kiyosaki advises investors to consider investing in Bitcoin as part of a diversified strategy amidst looming financial uncertainty. He aligns with forecasts from other influential figures, reinforcing the bullish sentiment surrounding cryptocurrencies and suggesting they are a hedge against economic downturns.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.