Delta Air Lines Witnesses Robust Growth in Domestic and International Travel in Q1

Introduction

Shares of Delta Air Lines (NYSE: DAL) turned red in midday trade on Wednesday after gaining earlier in the day, following the company’s announcement of its earnings results for the first quarter of 2024, in which revenue and profits beat estimates.

Better-than-expected results

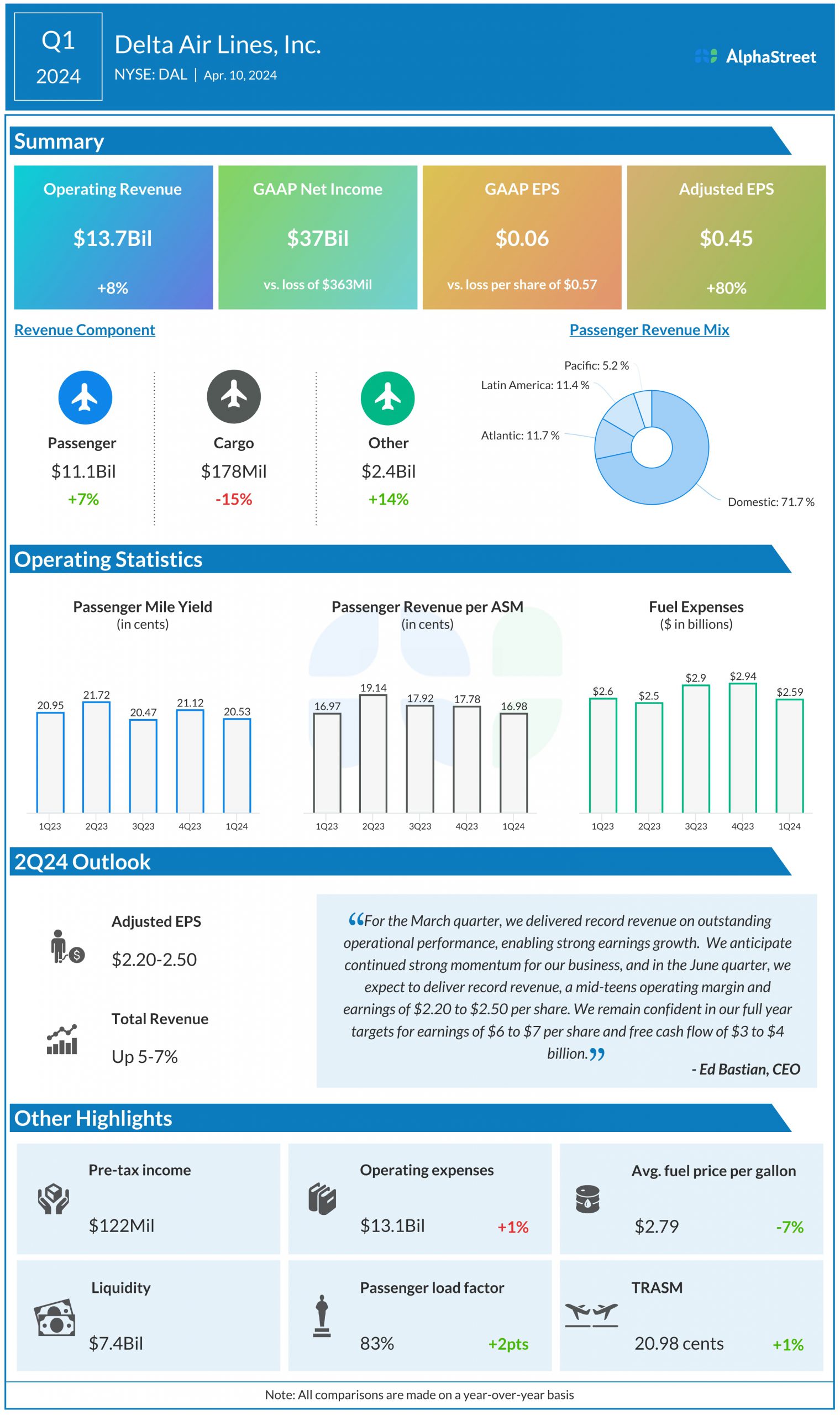

Delta Air Lines delivered operating revenue of $13.7 billion for Q1 2024, up 8% YoY and exceeding estimates. Adjusted operating revenue rose 6% to $12.5 billion. Delta reported a net income of $37 million, or $0.06 per share, compared to a net loss last year. Adjusted EPS increased to $0.45, an 80% jump from the previous year.

Business performance

Delta saw increased demand for travel, with strong growth in both domestic and international passenger revenue. Corporate travel also rebounded during the quarter. Total revenue per available seat mile (TRASM) rose by 1% YoY, while passenger load factor was 83%. Cost per available seat mile (CASM) decreased by 6%.

Outlook

Delta projects revenue to rise 5-7% year-over-year in Q2 2024, with TRASM expected to be flat to down 2%. The company anticipates EPS between $2.20-2.50 for Q2 and $6-7 for the full year 2024.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.