Taiwan Semiconductor Stock Surges Amid Funding Boost

A flurry of activity

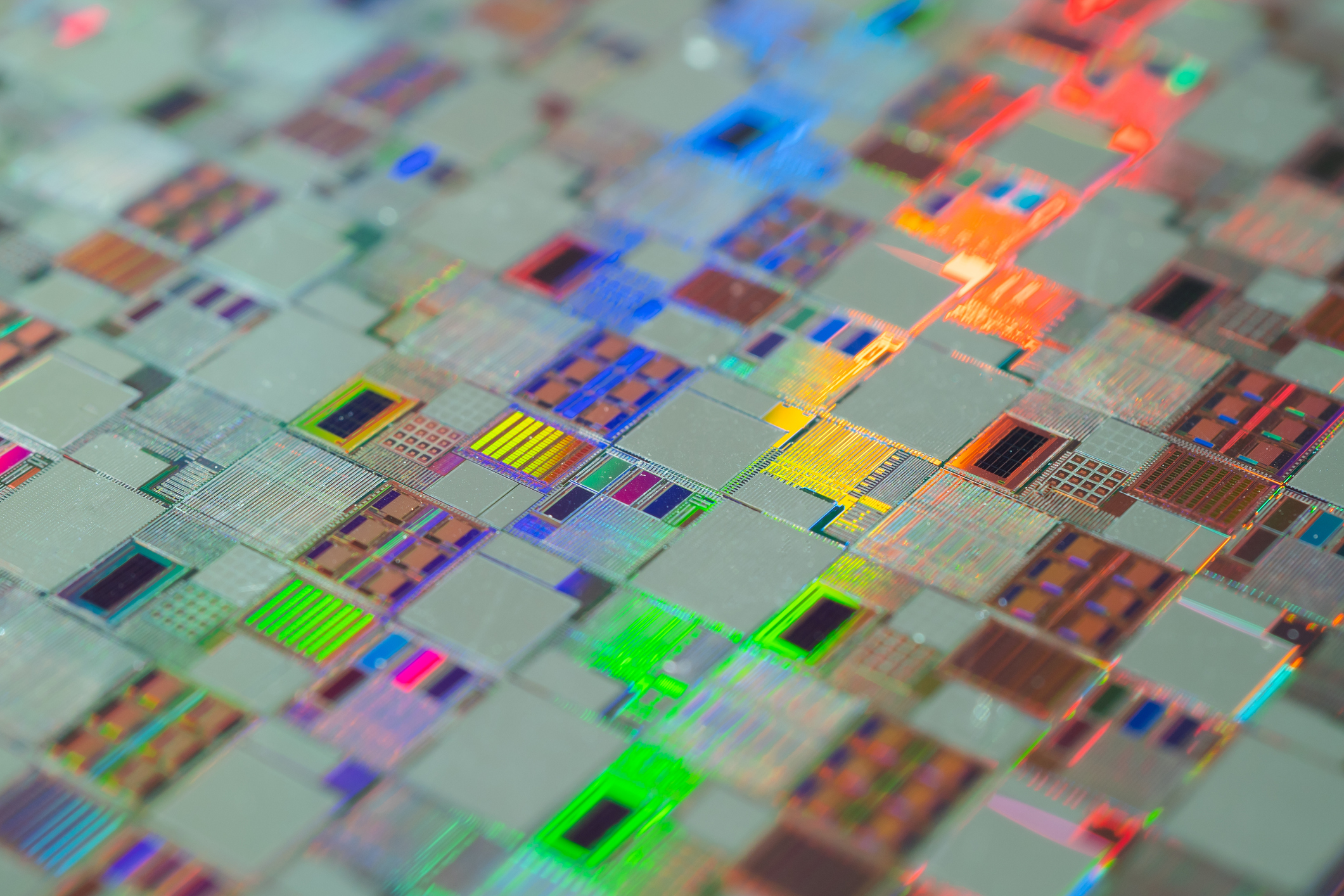

Taiwan Semiconductor, commonly called TSMC, continued to benefit from the funding received under the CHIPS Act, with plans for expansion in Phoenix. Micron is also expecting price hikes for its memory and storage chips after a recent earthquake. Additionally, Arm Holdings anticipates the success of its upcoming AI-centric laptops surpassing competitors.

To buy or not to buy

- Taiwan Semiconductor offers favorable valuation at just 23 times forward earnings. Micron trades at less than 4 times forward sales with a positive revenue outlook. Arm's stock prices may seem high, but its growth prospects make it an undervalued stock based on the PEG ratio.

- The expanding AI market is set to drive continued growth in the chip sector, making semiconductor stocks appealing long-term investments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.