IMF Warning on Private Credit Market Risks: Understanding the Implications

IMF Warning on Private Credit Market Risks

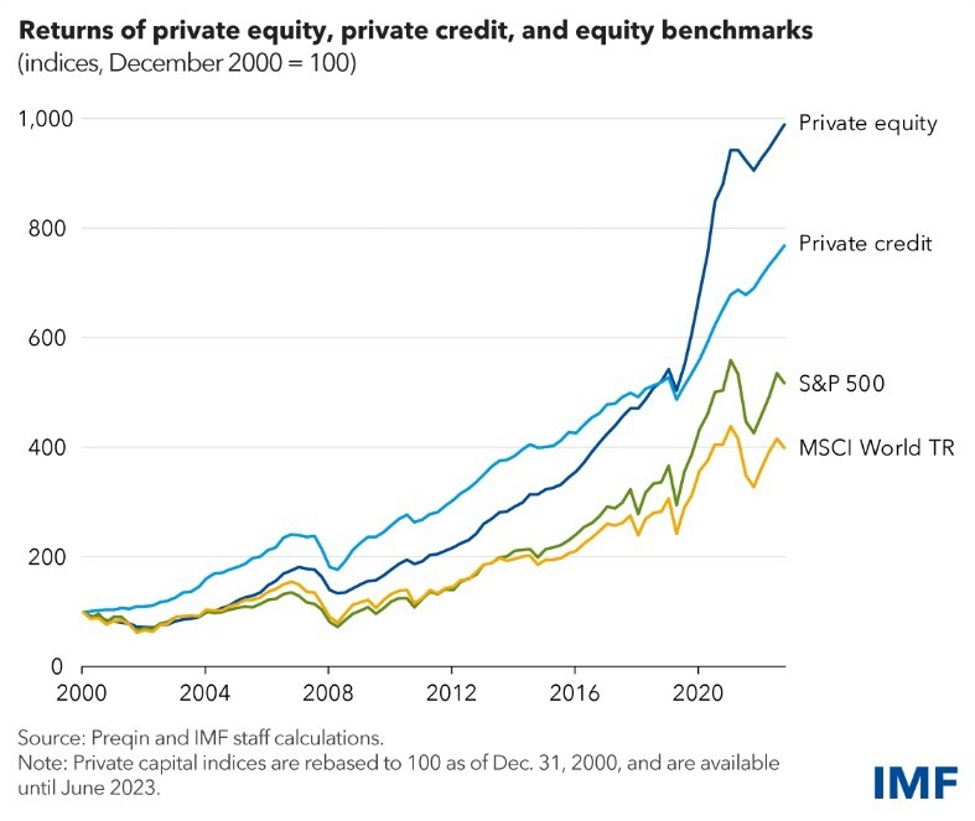

This is not the first time the International Monetary Fund (IMF) have issued a warning on the opaque and highly interconnected segment of the financial system: Private corporate credit has created significant economic benefits by providing long-term financing to corporate borrowers.

Economic Impact of Private Credit Market

- Opaque Nature: Valuation in private credit is infrequent, and credit quality is not always clear, leading to potential risks.

- Interconnected System: Private credit funds, private equity firms, and commercial banks are interlinked, making it difficult to assess systemic risks.

- Potential Systemic Risk: Due to the lack of transparency and oversight, existing vulnerabilities could escalate into systemic risks for the broader financial system.

Background on the private credit market reveals its emergence as a financing alternative for companies excluded from traditional methods. With its rapid growth and popularity among institutional investors, concerns about potential risks and systemic impact arise.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.