Earnings Preview: Analyzing CarMax’s Stock Performance and Future Outlook

Q4 Estimates

The company's fourth-quarter report is expected to come on Thursday, April 11, at 6:50 am ET. Analysts' consensus earnings estimate is $0.47 per share, compared to $0.44 per share in the corresponding period of 2023. The forecast for Q4 revenue is $5.79 billion, slightly higher than the $5.72 billion a year earlier.

Digital Push

The article also discusses CarMax’s efficient e-commerce platform and store network expansion. Amid market challenges, the company aims to navigate through headwinds by focusing on cost reduction and omnichannel capabilities.

Demand Slump

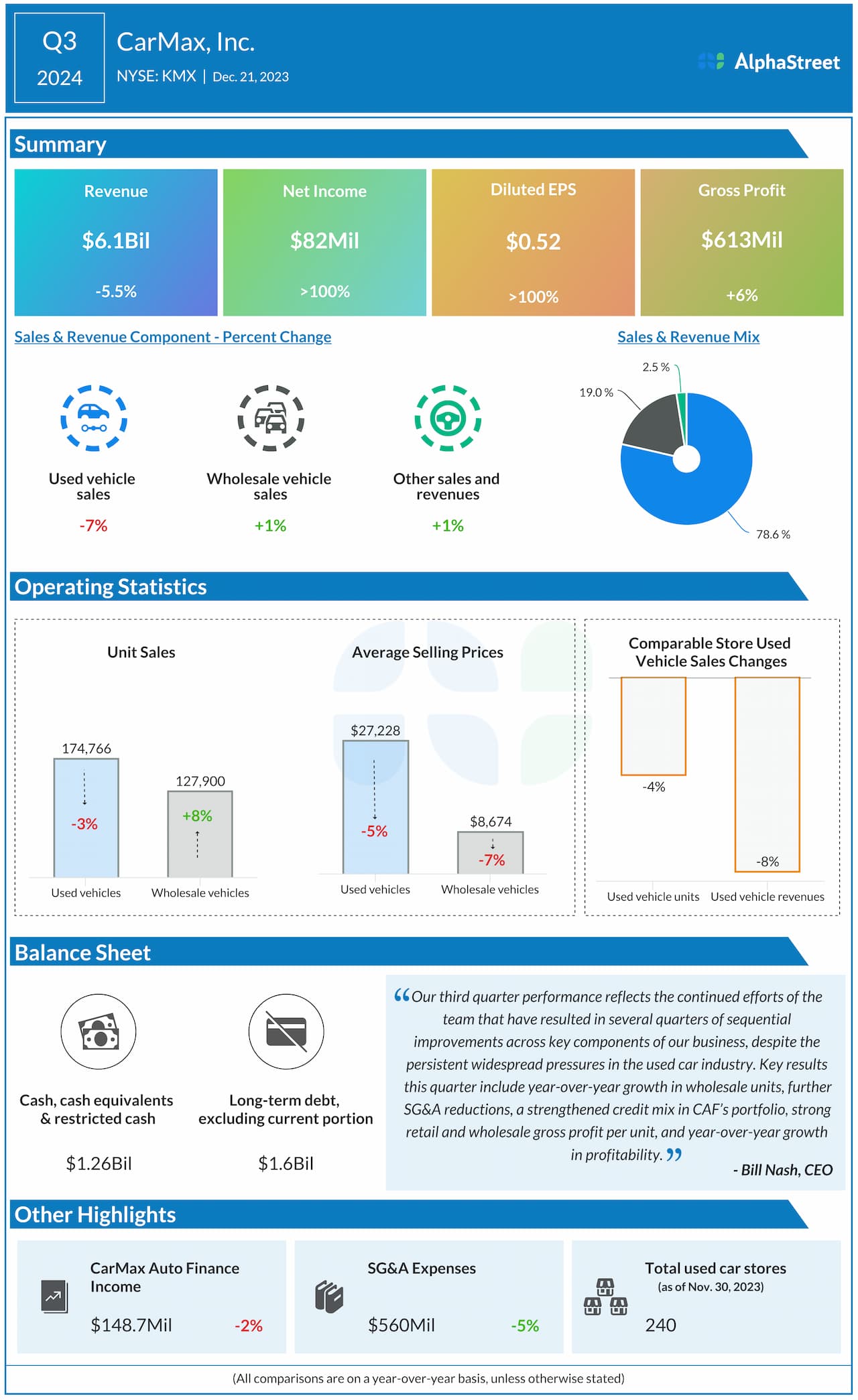

The weak Q3 revenue, partly attributed to a 7% fall in used vehicle sales, underlines ongoing challenges. Nevertheless, CarMax’s long-term potential is noted, with the stock trading below its peak and poised for recovery.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.