Understanding What the Fed Decision Means for Markets Beyond the Near Term

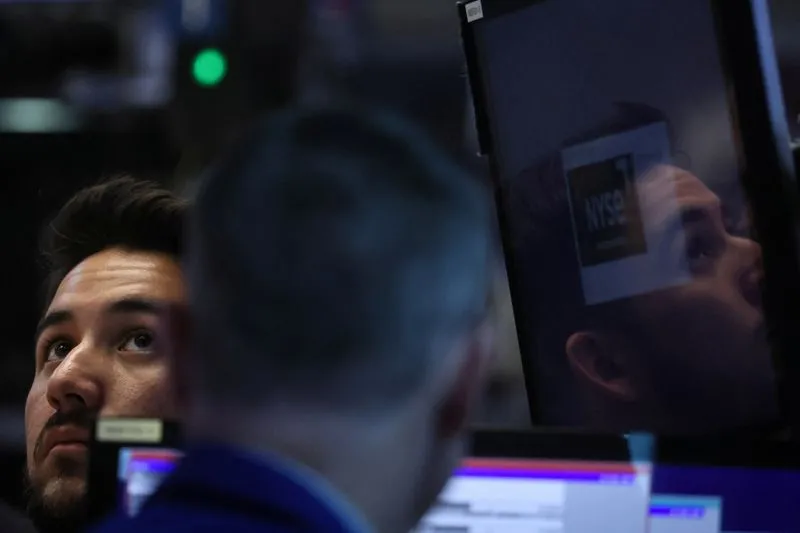

What the Fed Decision Means for Markets

The Federal Reserve's recent decision to cut interest rates by 50 basis points has significantly impacted markets. Investors must grasp the long-term consequences of this dovish shift.

Immediate Reactions in Financial Markets

Following the announcement, equity markets surged, signaling investor optimism. However, a deeper examination reveals potential challenges ahead.

- Bond Yields are likely to fluctuate as investors adjust to lower rates.

- Investor Sentiment may shift as market dynamics evolve.

Long-Term Implications

While the short-term effects are evident, the long-term ramifications of this Fed decision are still unclear.

- Inflation could be influenced by sustained rate cuts.

- Investment Strategies may need reevaluation.

For a deeper analysis and continuous updates, be sure to monitor relevant financial sources.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.