Which Path Will the Fed Take to Ease Monetary Policy? Current Analysis

The Federal Reserve's Recent Actions

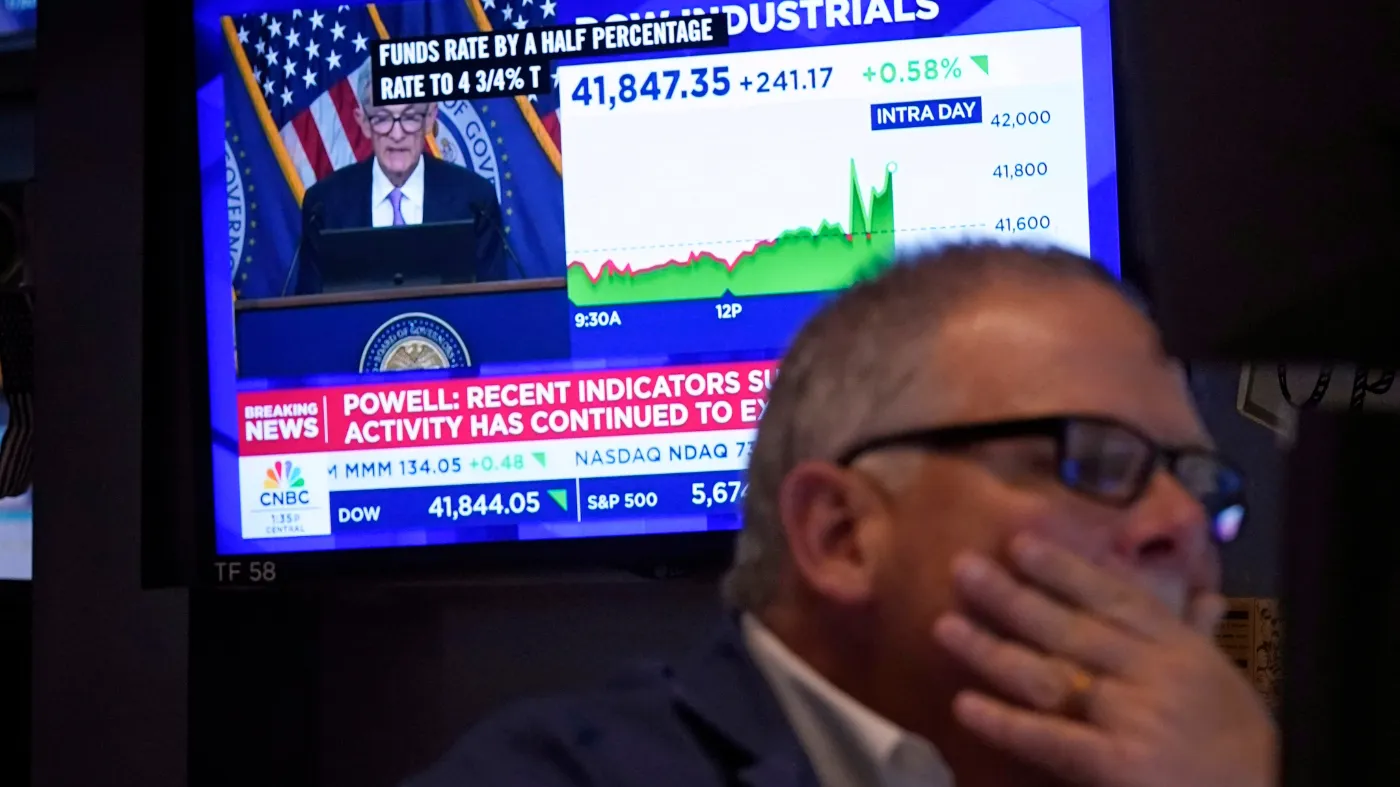

This week marked a significant shift as the Federal Reserve initiated a new easing cycle by reducing the federal funds rate by a half percentage point. Market reactions suggested this cut was largely anticipated, reflecting evolving sentiments concerning inflation and employment metrics.

Inflation Versus Employment: A Delicate Balance

According to Fed Chair Jerome Powell, the adjustment symbolizes confidence in achieving a 2 percent inflation target, particularly amidst a cooled labor market. The shift in risk dynamics now leans toward protecting job markets, minimizing deterioration in employment rates.

- Media predictions recommend the Fed funds rate may drop to 3.25-3.5 percent by year-end.

- The Fed refrains from aggressive cuts as recession signs remain minimal.

Understanding Market Sentiments

Despite rising volatility, many investors view a 'soft landing' as plausible. The current economic climate, devoid of traditional recession pressures, complicates rate adjustment forecasting. The need for data-responsive decisions reinforces investor concerns regarding the Fed's lagging reactions.

Fiscal Policy Implications

Looking ahead to 2025, looming policy decisions will further influence economic outcomes. Whether to extend tax cuts or increase corporate taxes is pivotal to economic momentum.

- Trump's tax cuts could entail substantial costs over a decade.

- Harris's tax policies are still forming, creating ambiguity for future fiscal strategies.

Ultimately, the Fed's strategy will require careful consideration of any fiscal policy shifts post-election, further complicating current monetary policy landscape assessments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.