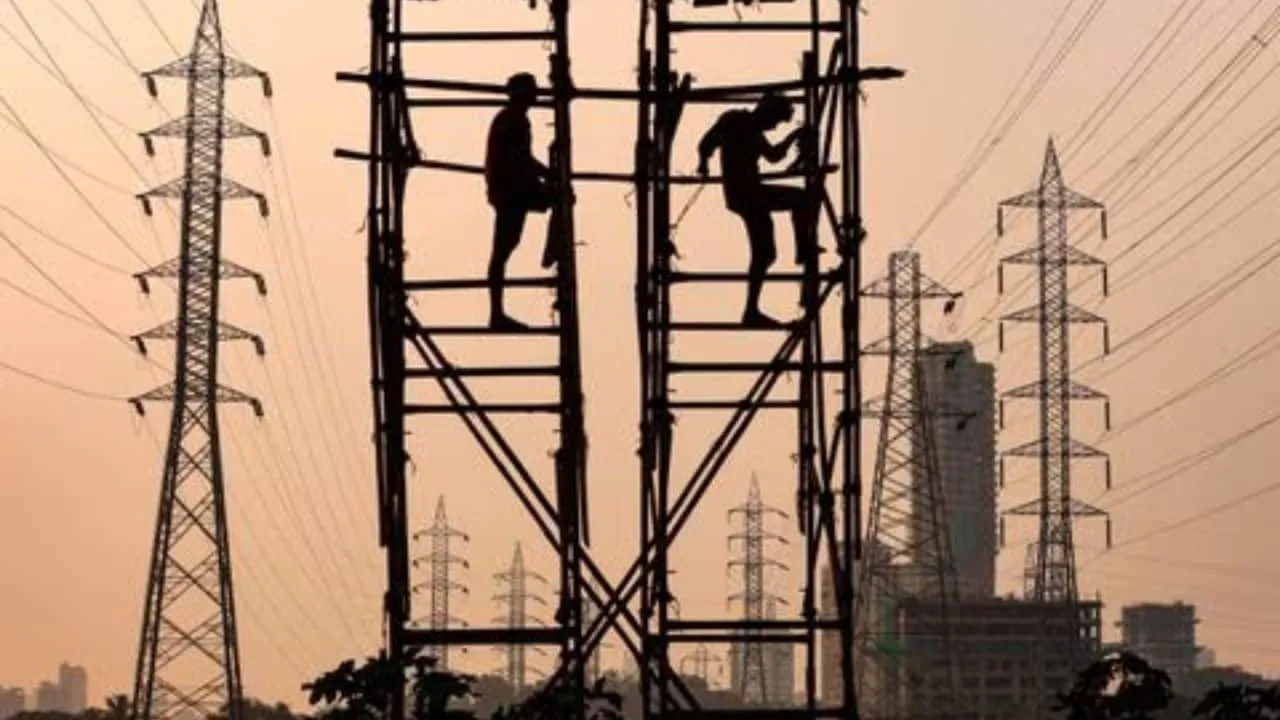

Bangladesh Crisis: Urgent Forex Arrangement to Settle Indian Power Dues

Bangladesh Government's Forex Arrangement Amid Crisis

In the wake of the ongoing Bangladesh crisis, the government is actively securing forex to settle overdue payments owed to Indian power firms, particularly Adani Power and SEIL Energy. Letters issued by state-owned Rupali Bank to lenders ICICI Bank and IndusInd Bank clarify the seriousness of the situation, detailing an outstanding amount of $190 million owed to SEIL and over $79 million to PTC India.

Details of the Outstanding Payments

- SEIL is owed significant sums, with payments delayed despite assurances.

- PTC India has been a critical supplier, providing 250 MW of power to BPDB since 2013.

- Indian power companies collectively face over $1 billion in dues from Bangladesh.

Financial Impact and Implications

The ramifications of these power dues are far-reaching, with economists raising concerns about the ongoing stability of energy transactions. PTC's interim CMD mentioned ongoing communication with Bangladeshi authorities ensures that contractual obligations can be met.

Future Outlook for Indian Power Firms

- Adani Power alone accounts for nearly $800 million of outstanding payments.

- The resolution of these dues is critical not just for Indian firms but also for Bangladesh's power supply stability.

- Urgent action is crucial to prevent any disruption in energy imports from India.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.