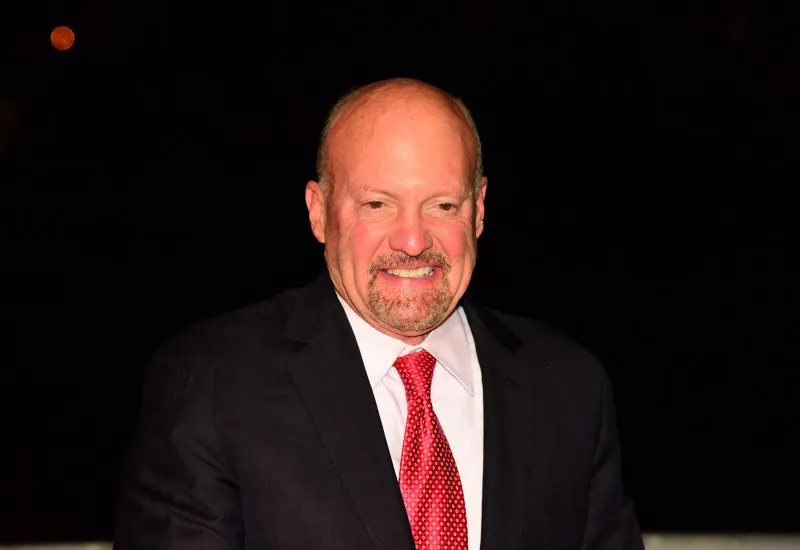

Cramer’s Bullish Comments Can't Save FedEx (FDX) Stock From Plummeting

Impact of Cramer’s Praise on FedEx Stock

Despite Jim Cramer’s glowing endorsement of FedEx (NYSE: FDX) as a promising stock to own, the reality has set in as the company’s shares fell drastically just days later. Initially heralded on September 18 as a worthy investment amidst anticipated interest rate cuts, FDX stock proved otherwise, plummeting nearly 16% in one day from approximately $309 to around $258.

FedEx Stock Performance Analysis

After Cramer’s optimistic remarks, FedEx’s stock price declined significantly, with an even steeper drop of 13.13% on a given day and a 10.42% deduction over the month. Currently priced at $273.45, the stock struggles to sustain its year-to-date gains of only 3.52%.

Reasons Behind the Decline

- Disappointing 1st Quarter Earnings: FedEx reported weaker-than-expected earnings that fell short of analyst predictions.

- Revised Earnings Guidance: The logistics giant lowered its full-year earnings outlook, a major red flag for investors.

- Analyst Downgrades: Firms like Morgan Stanley have downgraded FDX stock, indicating more significant risks ahead.

Analysts suggest that the grim earnings results signal a troubling trend for FedEx, which may lead to further bearish momentum. Investing in FDX is fraught with challenges, pressing investors to conduct thorough research before making decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.