Factors Influencing 10-Year Yields: A Detailed Analysis by ING

Monday, 8 April 2024, 10:12

Key Takeaways:

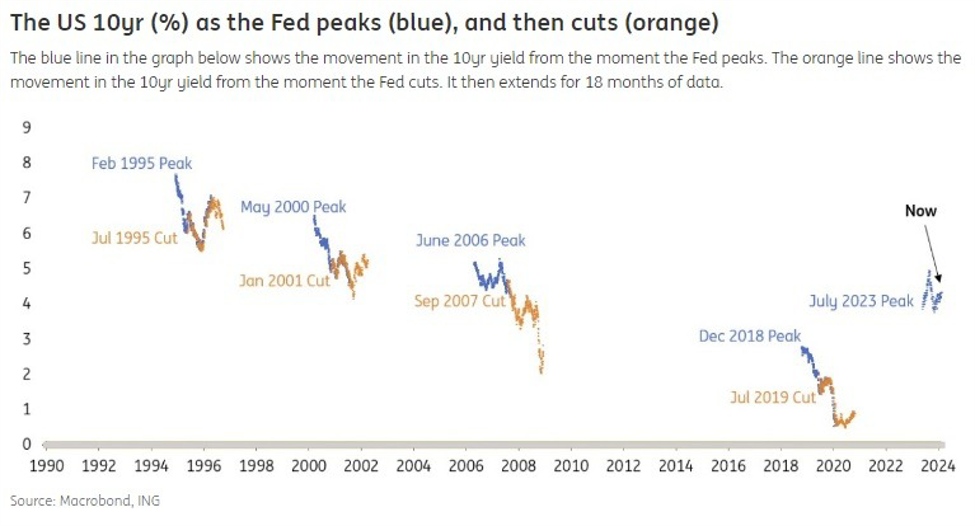

Some interesting points from ING about 10-year yields, and the risks they see that could take us back to 5%.

Current Cycle Analysis:

- Market rates have remained steady post-Fed's rate peak, unlike previous cycles.

- Historically, market rates tend to increase temporarily when the Fed cuts rates.

Contrary to expectations, the 10-year yield has not decreased significantly, partly due to a relative shortage of longer-dated Treasuries from the pandemic-induced holdings.

Future Outlook:

- Uncertainty surrounds whether the Fed has peaked, delaying a potential rate cut confirmation.

- Anticipated inflation readings may further pressure 10-year yields, possibly leading to a retest of 5%.

- The data ahead of the Fed's June meeting will be crucial in determining market movements.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.