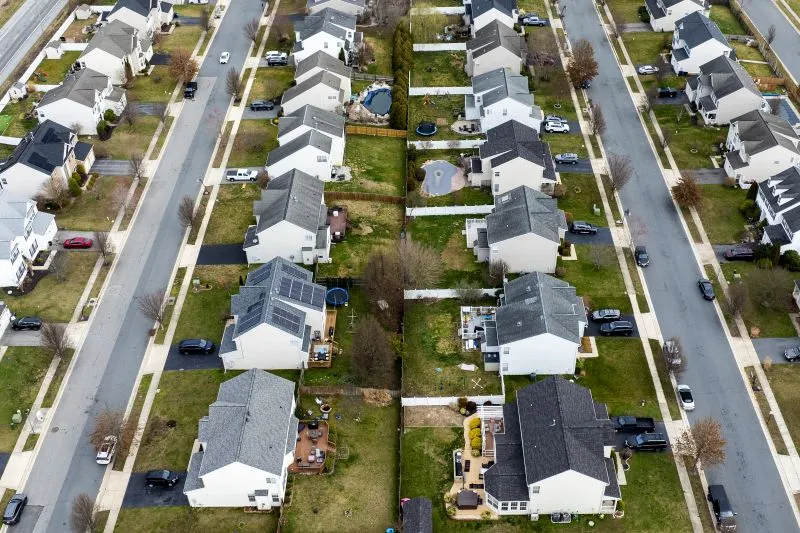

Understanding the Impact of the Fed's Interest Rate Cut on Homeowners and Potential Buyers

The Fed's Impact on Housing Market

The Federal Reserve's recent decision to cut interest rates by half a percentage point marks a pivotal shift in the US economic landscape. As the housing market is particularly sensitive to these changes, the implications for homeowners and potential buyers are profound.

Current Housing Market Dynamics

Elevated mortgage rates and housing prices have previously constrained home affordability. However, the current interest rate cut could lead to an increase in home sales. Demand has remained high, but the supply of homes for sale has been inadequate due to homeowners' reluctance to sell in a higher-rate environment.

Potential for Increased Activity

Experts suggest that falling mortgage rates could motivate more homeowners to sell, contributing to a more balanced market. The 30-year fixed-rate mortgage averaged 6.09%, down from 7.79% last fall, fueling optimism among prospective buyers.

Outlook for Homeowners and Buyers

As the Fed hints at further rate cuts, the outlook for both current homeowners and potential buyers looks promising. Individuals contemplating their next steps in the real estate market may find this an opportune moment. How do you view these changes?

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.