Banking and Finance Trends: S&P 500 at Record High After Fed's Decision

Banking and Finance Impact on Stocks

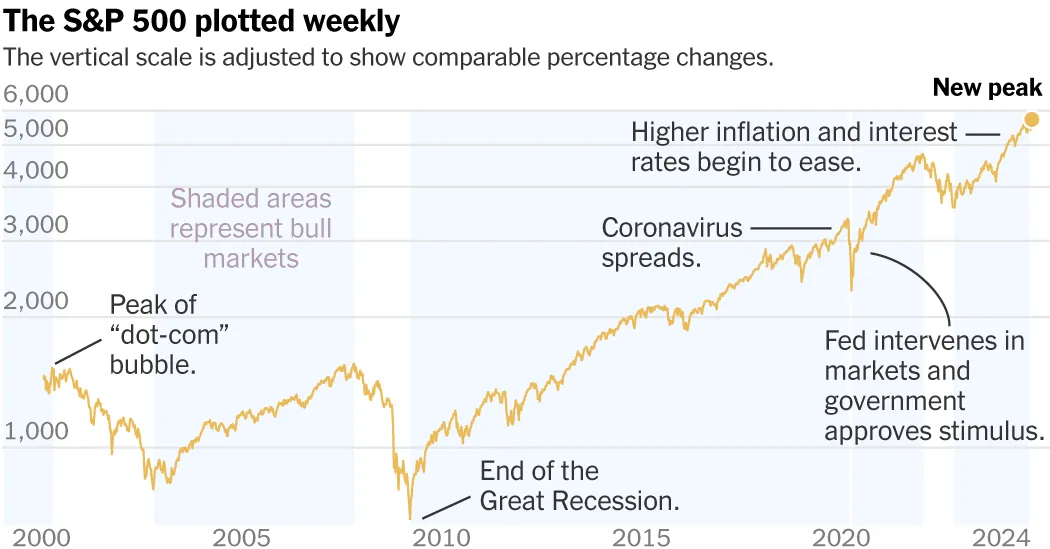

The recent cut in interest rates by the Federal Reserve has significantly influenced the banking and finance sectors. As Jerome Powell, the chair of the Federal Reserve, announced the cut, the S&P 500 reacted positively, demonstrating investor confidence.

Key Highlights

- Record Highs: The S&P 500 has reached new highs, showcasing the market's resilience.

- Investors' Optimism: A growing belief in the stability of stocks and bonds amidst changing regulations.

- Regulatory Shifts: The impact of regulation and deregulation could reshape investment strategies moving forward.

Looking Forward

Market observers are keenly analyzing the Federal Reserve's next steps, especially in relation to the Russell 2000 and broader indicators of the US economy. Continuous monitoring of stocks, bonds, and potential changes in regulatory frameworks will be necessary for investors to strategize effectively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.