Buying or Renting a Home? Here’s What to Avoid Amid Common Scams

Common Scams Targeting Homebuyers

Buying or renting a home can make individuals particularly susceptible to scams. Scammers view house hunters as easy targets, especially those eager for favorable deals. In 2022, statistics revealed that over 40 million homebuyers and renters were cost-burdened, spending at least 30% of their income on housing. During the five-year span from 2018 to 2023, nearly 70,000 cybercrimes related to real estate and home rentals were reported to the FBI.

The Increase in Housing Scams

These alarming figures indicate a troubling trend of scammers exploiting the home buying process, aiming to exploit individuals desperate for financial relief. Reports have surfaced where scammers masquerade as representatives from government low-income housing programs.

- One infamous case involved a fake waiting list posted on social media.

- Scammers soliciting personal information through fraudulent applications have also become common.

Types of Scams to Watch Out For

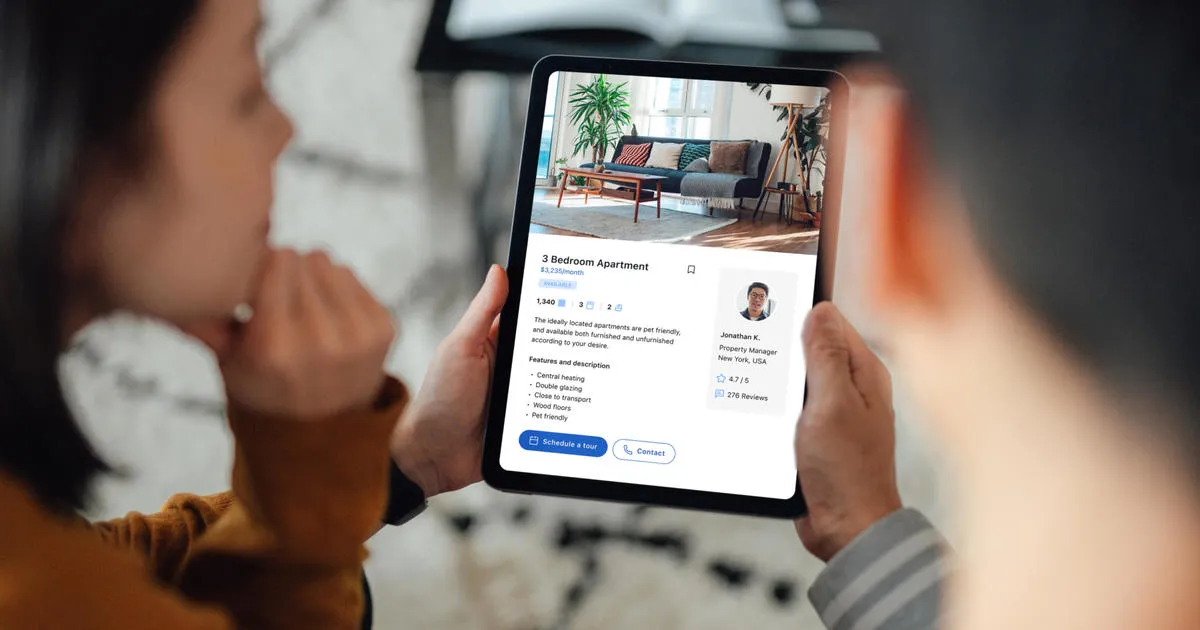

Additionally, there has been a surge in fake housing listings from criminals posing as legitimate sellers. Often featuring unrealistically low prices, these scams utilize manipulated images and create a facade of legitimacy through seller impersonation fraud. There are instances where properties valued at over $1 million are illicitly advertised for prices as low as $10,200.

Five Essential Tips for Homebuyers

- Research Local Home Prices: Compare listings and identify deals that seem too good to be true.

- Verify Seller Documentation: Ensure contact information aligns with property ownership records.

- Avoid Upfront Payments: Be cautious of sellers pressuring for early financial commitments.

- Visit Properties in Person: Always confirm the existence of a property.

- Authenticate Websites and Ads: Validate the authenticity before sharing personal information.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.