Understanding the Interest Rate Cut's Effects on Real Estate, Car Loans, and Debt

Thursday, 19 September 2024, 05:58

Interest Rate Cut Overview

The recent interest rate cut of 0.5% by the Federal Reserve marks the first reduction since 2020. This move is anticipated to have substantial implications across various sectors.

Effects on Real Estate

- Lower mortgage rates can increase housing affordability.

- Property investment opportunities are likely to rise.

- Homebuyers may rush to enter the market.

Implications for Car Loans

- Interest rate cut leads to reduced car loan rates.

- New vehicle purchases could surge.

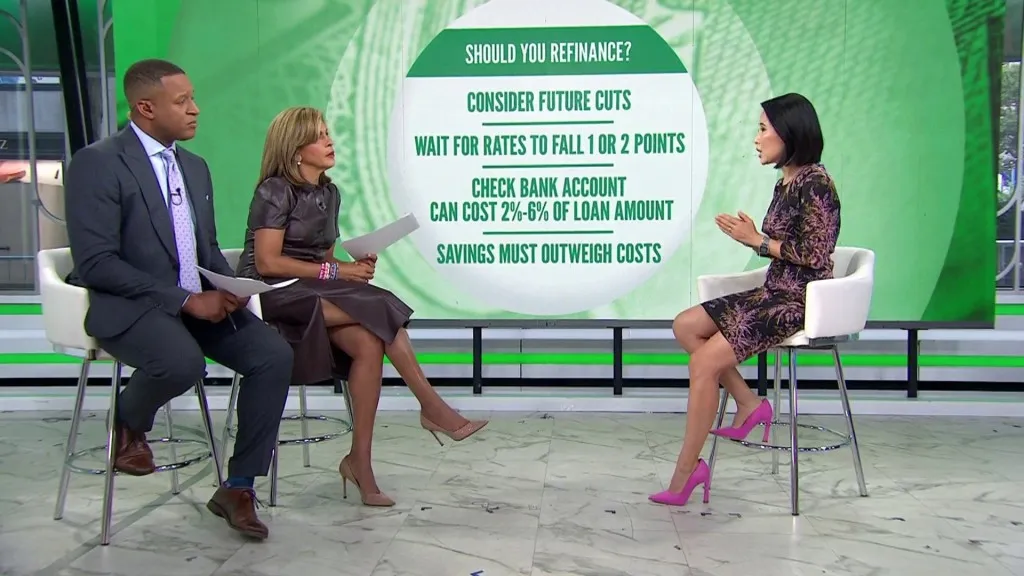

- Current loan holders may seek refinancing options.

Debt Management Strategies

With lower interest rates, managing existing debt may become more feasible. Financial experts recommend consolidating high-interest debts to maximize savings.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.