Mortgages and Fed Rate Cuts: Essential Insights for Consumers

Understanding the Impact of Fed Rate Cuts on Mortgages

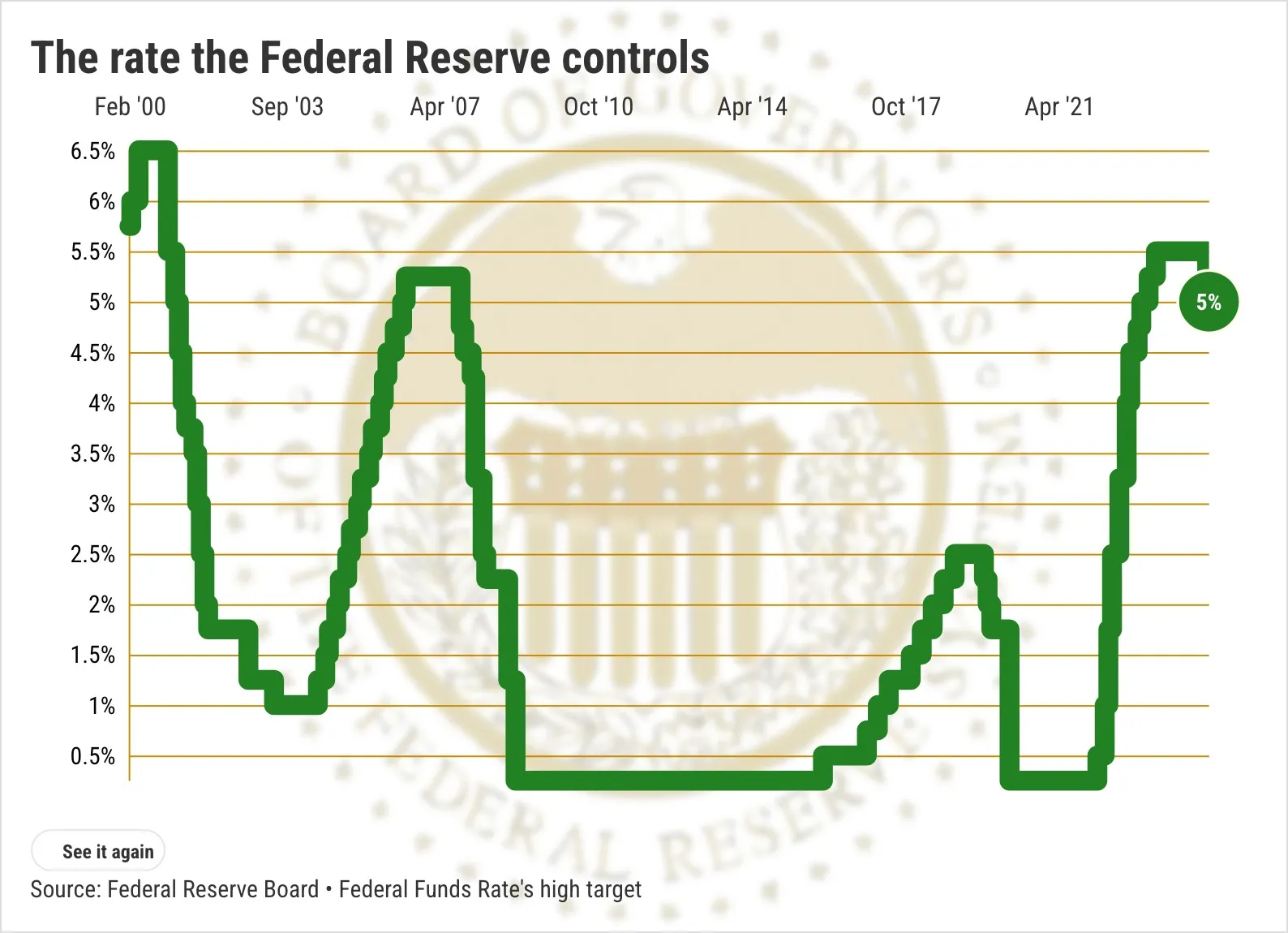

When it comes to mortgages, the recent cuts by the Federal Reserve have substantial implications. With the benchmark interest rate now lowered from its 23-year high, borrowers can expect fluctuations in their mortgage rates.

Consequences for Borrowers

- Lower Rates: Many consumers may benefit from reduced falling borrowing costs.

- Refinancing Opportunities: Homeowners could think about refinancing to take advantage of lower rates.

- Purchasing Power: With lower mortgages, prospective buyers might see increased purchasing power.

Broader Market Effects

The ripple effect of lower rates extends beyond mortgages, impacting auto loans, personal loans, and credit cards. Understanding these financial dynamics helps in making informed decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.